The global new shipbuilding market has continued to develop favorably since the beginning of 2024. Major South Korean shipbuilders have been focusing on high value-added vessels such as liquefied natural gas (LNG) carriers and very large ammonia carriers (VLAC), and have accumulated workloads for the next three to four years. Since last year, South Korean shipbuilders have begun to return to profitability after years of losses, which also means that the shipbuilding industry has ushered in a “super cycle” after many years. Nevertheless, the Korean shipbuilding industry is still facing a tense situation.

South Korean media reports that although South Korea leads the market for environmentally friendly high value-added ships, China’s share of the overall shipbuilding market is overwhelming. Even in the high value-added ship market, Chinese shipbuilding enterprises have been playing catch-up, committed to narrowing the technology gap between the two sides. With Chinese shipbuilders narrowing the technological gap between China and South Korea, it means that the boom period for South Korea’s shipbuilding industry will also come to an end. At present, the South Korean industry is calling for more active, larger single research and development (R & D), to “super gap technology advantage” to shake off the Chinese shipbuilding enterprises to chase.

Overwhelming market share, with half of all new vessels produced by Chinese shipyards

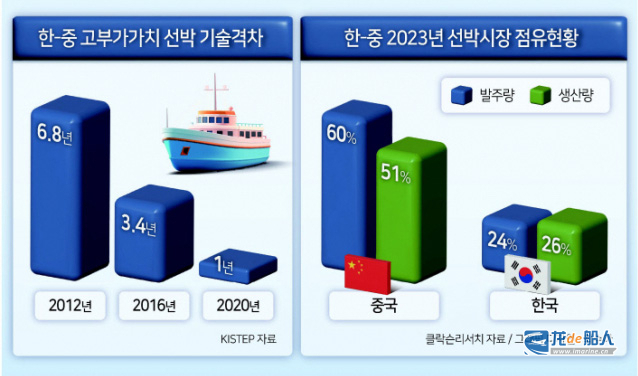

Clarkson said on March 21, 2023, the global new ship orders for 41.68 million compensated gross tonnage(CGT), during this period, China’s shipbuilding enterprises orders for 24.93 million CGT, market share of about 60%. South Korea’s shipbuilding enterprises orders totaled 10.08 million CGT, market share of 24%. Clarkson data show that by the end of February 2024 as a benchmark, the global hand-held new ship orders for 125.88 million CGT, of which, China’s shipbuilding enterprises hand-held orders for 62.23 million CGT, market share of about 49%; South Korea’s shipbuilding enterprises hand-held orders for 38.61 million CGT, market share of about 31%.

The above data shows that Chinese shipbuilders have taken a clear advantage in terms of newbuilding market share, while South Korean shipbuilders have maintained a market share of about 32% since 2008, but the gap with Chinese shipbuilders widened significantly last year, with the difference reaching about 36%. Meanwhile, Chinese shipbuilders’ merchant ship production reached 51% in 2023, more than half for the first time in history, indicating that China’s ship production is experiencing explosive growth, compared with only 8% in 2002. Last year, South Korea’s ship production was around 26%. It is said that this is due to the South Korean shipbuildings hand-held order quantity is sufficient, and take high value-added ship-based order screening strategy, and because the South Korean shipbuilding industry as a whole is facing a shortage of labor, so that it is a little passive in the order negotiation.

Korea Export-Import Bank Overseas Economic Research Institute pointed out that China is currently through the national strategy to steadily increase domestic orders, and continue to expand previously monopolized by the South Korean shipbuilding enterprises in the large ship market share. In the environmentally friendly alternative fuel-powered ship market, Chinese shipbuilders are also gradually narrowing the gap with South Korea, and in the large container ships and other orders to gradually take advantage of the competition. It is worth noting that even in the high value-added ship market, the technology gap between Chinese and South Korean shipbuildings is also narrowing. According to the Korea Institute of Science and Technology Evaluation and Planning (KISTEP) data, in the environmentally friendly ships, smart ships and other high value-added ship technology, the technology gap between Chinese and South Korean shipbuilding enterprises was 6.8 years in 2012, halved to 3.4 years in 2016, and further narrowed to 1 year in 2020.

Taking ultra-large LNG carriers as an example, South Korean shipyards used to be at the forefront of the world in this field. Now, in the field of research and development of larger capacity 270,000 m3 class LNG carriers, Chinese shipbuilders have already achieved a late advancement. 271,000 m3 LNG carrier design developed by Hudong-Zhonghua Shipbuilding, a subsidiary of China State Shipbuilding Corporation (CSSC), was approved in principle (AiP) by the four major international classification societies, namely ABS, LR, BV, and DNV, on September 5, 2023, making it the largest LNG carrier in the world so far. At the same time, this 271,000 m3 LNG carrier has already received a live order from QatarEnergy and is expected to receive additional orders.

McKinsey & Company, the world’s largest management consulting firm, also noted in a report titled “Korea’s Next S-Curve: A New Economic Growth Model for 2040,” that “in the shipbuilding industry, the technological gap between China and South Korea in terms of high-value-added ships is narrowing. If this situation persists, price competition between Chinese and South Korean shipbuilders is likely to intensify.”

Although South Korean shipbuilders in the field of high value-added ships such as LNG carriers still have a clear competitive advantage, but the qualitative leap in China’s shipbuilding industry is also difficult to ignore. Taking LNG carriers alone as an example, the share of orders from Chinese shipbuilders has jumped from 8 % in 2021 to 30 % in 2022. Although this value dropped to 20% last year, Chinese shipbuilders are gradually improving their competitiveness as they expand their order strategy centered on domestic shipping companies to global shipping companies.

China’s shipbuilding industry to usher in high-quality development with national policy support

At the end of last year, five ministries and commissions, namely, the Ministry of Industry and Information Technology, the National Development and Reform Commission, the Ministry of Finance, the Ministry of Ecology and Environment and the Ministry of Transportation, jointly issued the Outline of Action for the Green Development of the Shipbuilding Manufacturing Industry (2024-2030).

The Outline specifies that by 2025, the green development system of ship manufacturing industry will be initially constructed, the supply capacity of green ship products will be further improved, the application of marine alternative fuels and new energy technologies will be synchronized with the international level, and the international market share of green-powered ships, such as liquefied natural gas (LNG), methanol, etc. will be more than 50%; and that by 2030, the green development system of ship manufacturing industry will be basically completed, and the supply capacity of green ship products will be formed with a complete spectrum. By 2030, the green development system of ship manufacturing industry will be basically completed, green ship products will form a complete spectrum of supply capacity, green ship technology will have international advanced level, and the international market share of green ships will remain the world’s leading. Under the support of national policies, China’s shipbuilding industry will also usher in high-quality development.

During the second meeting of the 14th National People’s Congress (NPC) held earlier this month, Wang Qihong, deputy party secretary and director of the National People’s Congress, CSIC No.725 Research Institute, pointed out that: “At present, China’s ship and ocean engineering materials technology system has basically been formed, but in the LNG carriers, large cruise ships, polar research ships and other High-value-added ships and advanced materials for extreme working conditions in the basic research is still a big gap, the key materials and technologies are mainly in the hands of developed countries mainly in Europe, America, Japan and South Korea, seriously affecting the international competitiveness of China’s ship and sea industry.It is recommended to focus on the future development and transformation of the ship and sea industry and the urgent need for major technology and equipment as the main direction of attack, pay attention to the basic research of ship and sea materials (including technology), strengthen the stable support for basic research, pay attention to the assessment of the application of the effectiveness of the baton into full play to promote the demonstration and application of ship and sea materials.”

South Korea’s shipbuilding industry grapples with series of challenges as sense of crisis grows

Due to the efforts of China’s shipbuilding industry to catch up, the Korean shipbuilding industry has actually felt a great sense of crisis. In response to a series of challenges, the Korean government is also actively supporting the development of the shipbuilding industry, and earlier this month announced the launch of a government-participatory cooperation platform “K-Shipbuilding Next Generation Initiative” to discuss the direction of the major transformation of the shipbuilding industry and to discuss ship exports and ensure technological superiority and other related content.

According to the agreement signed between the Korean government and the three major Korean shipbuilding companies (HD Korea Shipbuilding & Offshore Engineering, Hanwha Ocean, and Samsung Heavy Industries) and the Korea Marine Equipment Association (KOMEA), it has been decided to invest KRW 9 trillion (approx. US$6.74 billion) over the next five years to provide technology for the future development of the shipbuilding industry.

In the medium to long term, in order to secure next-generation shipbuilding technology, the Korean government and related companies will jointly formulate a “Shipbuilding R&D Map” in the first half of this year, and plan to develop the world’s first liquefied hydrogen carrier by 2030, and take the lead in formulating an international standard for autonomous navigation vessels.

In addition to large-scale investment in R&D, McKinsey points out that “as the technology gap in shipbuilding gradually narrows, it is necessary to reorganize the business model on the basis of horizontal cooperation with other industries. In order to get rid of the intensifying price competition, consideration can be given to expanding horizontally into the autonomous ship market, offshore wind power, big data and other fields. If shipbuilders consider entering the autonomous ship and offshore wind power markets, which are considered to be the core high-value-added industries of the future shipbuilding industry, it is difficult for them to become key players in the ecosystem based on their existing production capacity alone. In the case of autonomous navigation vessels, for example, the field will incorporate a wide range of industry technologies such as autopilot, IoT, big data and advanced sensors, and it will be difficult for traditional shipbuilders to acquire all the technologies they need, so they will need to collaborate with leading global companies.”

In addition, the Korean shipbuilding industry is facing a serious labor shortage.The Korea Offshore & Shipbuilding Association (KOSHIPA) predicted last year that the shipbuilding industry will be short of more than 12,000 workers starting this year, and by 2027, the manpower gap is expected to reach about 130,000 people, given the country’s ample production capacity of about 10 million CGT per year.The Korean government and shipbuilders are taking a number of measures to fill the manpower gap, with the Korean government announcing that it will establish a labor supply and demand forecasting system to prevent interruptions to the shipbuilding process due to labor shortages. HD Korea Shipbuilding & Offshore Engineering, Hanwha Ocean, and Samsung Heavy Industries have jointly decided to pilot an “Overseas Shipbuilding Human Resources Cooperation Center” in the first half of this year to Ensure that foreign laborers are locally trained and reintroduced into the system.