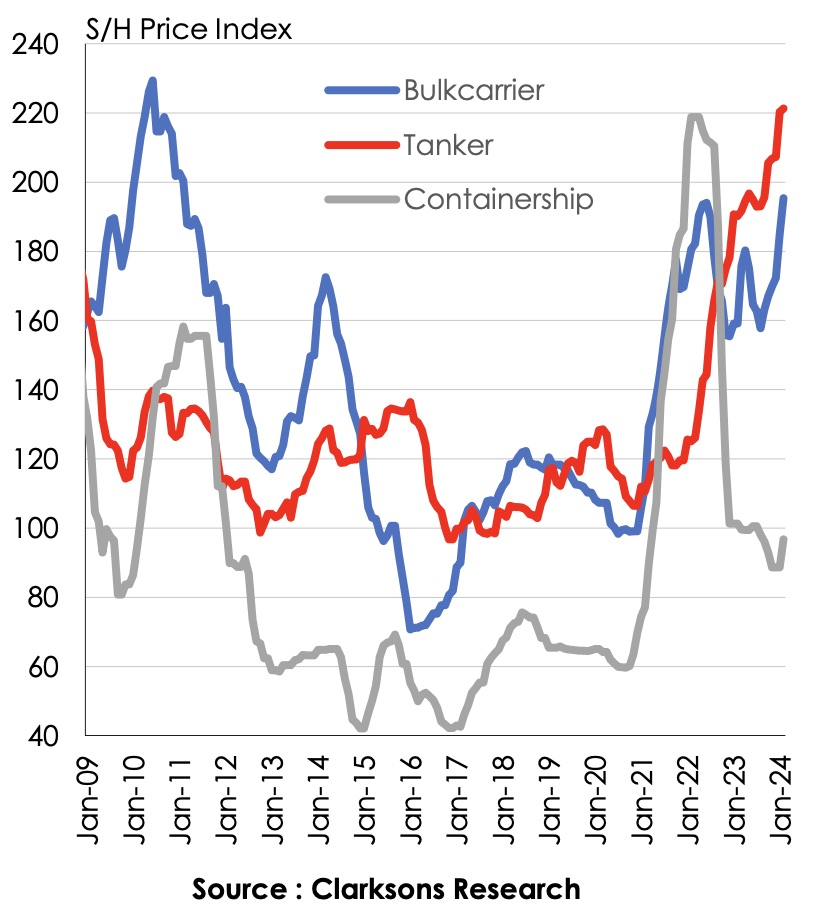

Secondhand tanker and bulker prices are at highs not seen for more than a decade, with owners scrambling for all available tonnage, pushing secondhand prices close to newbuild levels.

According to Clarksons Research, secondhand tanker prices are at a 15-year high, while secondhand bulk carrier prices are at close to the peak experienced in the wake of the global financial crisis.

Secondhand tanker prices have nearly doubled – up 98% – since the start of 2021, while bulk carriers are up by 85%.

Analysis by Clarksons shows the huge profits savvy investors could have made in VLCC investments in recent years.

A five-year-old VLCC purchased two years ago, operated spot and then sold today, would have generated an estimated $26m in earnings after opex and $30m on the asset play, a total investment return of $56m, according to estimates from Clarksons. On a $70m original outlay that’s a return of 80% over two years.

Secondhand suezmax prices have soared in the two years since the full-scale invasion of Ukraine by Russia.

A five-year-old suezmax was valued at $47m in February 2022, while currently, it costs around $83m, according to analysis from Greek broker Xclusiv. Ten and 15-year-old asset prices have more than doubled. Furthermore, during the last four-month period suezmax prices have gained momentum, with the five-year and 10-year old values being 12% and 14% up respectively.

Since early October 2023, secondhand bulker prices have gained momentum with the capesize sector experiencing a particular surge, with both prices and sales activity at high levels compared to recent years, according to Xclusiv. Notably, five-year-old, 10-year-old, and 15-year-old vessels saw their values jump by 18%, 27%, and 23%, respectively – the highest levels in the last five-year period. This optimism is translating into a vibrant sales market. Between October 2023 and February 2024, 55 capesizes changed hands.

The kamsarmax sector is also mirroring the capesize trend with rising prices and active sales.

“This upward trend is likely influenced by the limited newbuild deliveries comparing to the past, the investor optimism for a long-term rebound in freight rates and the asset diversification, as many owners are looking to spread their portfolio across different vessel segments,” Xclusiv noted.

Containership prices, which went through a massive correction last year, have been showing signs of firming again thanks to the Red Sea shipping crisis.

Brokers at Braemar noted today with the $16m sale of the 11-year-old, 1,850 teu Starship Leo that this was a further sign of the strong demand for anything with an eco slant.

“Discussions and trades continue on various ships at the time of writing in all segments with enquiry levels up across the board,” Braemar noted.

Last year marked the second highest year for ships changing hands and the first two months of this year suggest 2024 could break S&P records. 27m dwt, worth $10bn, of secondhand tonnage changed hands in January and February this year, according to Clarksons.