Vast amounts of new gas ship tonnage will flood the market this year, likely keeping a cap on rates. The latest installment in our Maritime CEO Annual Outlook.

The year 2024 promises to be a remarkable one for the LNG trades, setting multiple records.

January 17 marked the first time this century that no single LNG carrier was present in the Red Sea, a significant sign of how rapidly and tremendously the global seaborne map has changed in the months since the Houthis from Yemen – backed by Iranian intelligence and weaponry – came out in support of Hamas in the ongoing war with Israel.

For the LNG market, an extended shut-in of the Red Sea route from the Middle East poses a supply risk to Europe, although the price impact will be delayed until Europe’s gas storage has been drawn down sufficiently.

In 2023, around 15.5m tonnes of LNG was sent through the Red Sea from the Middle East to Europe accounting for 12.9% of the continent’s LNG supply last year.

Re-routing vessels through the Cape of Good Hope adds around 12.5 days to the voyage each way at 16 knots – which could require an additional 15-20 vessels to deliver the same volume over the year, analysis from Rystad Energy shows.

This could prove a useful soaking up of tonnage at a time where all-time high volumes of new ships are hitting the water.

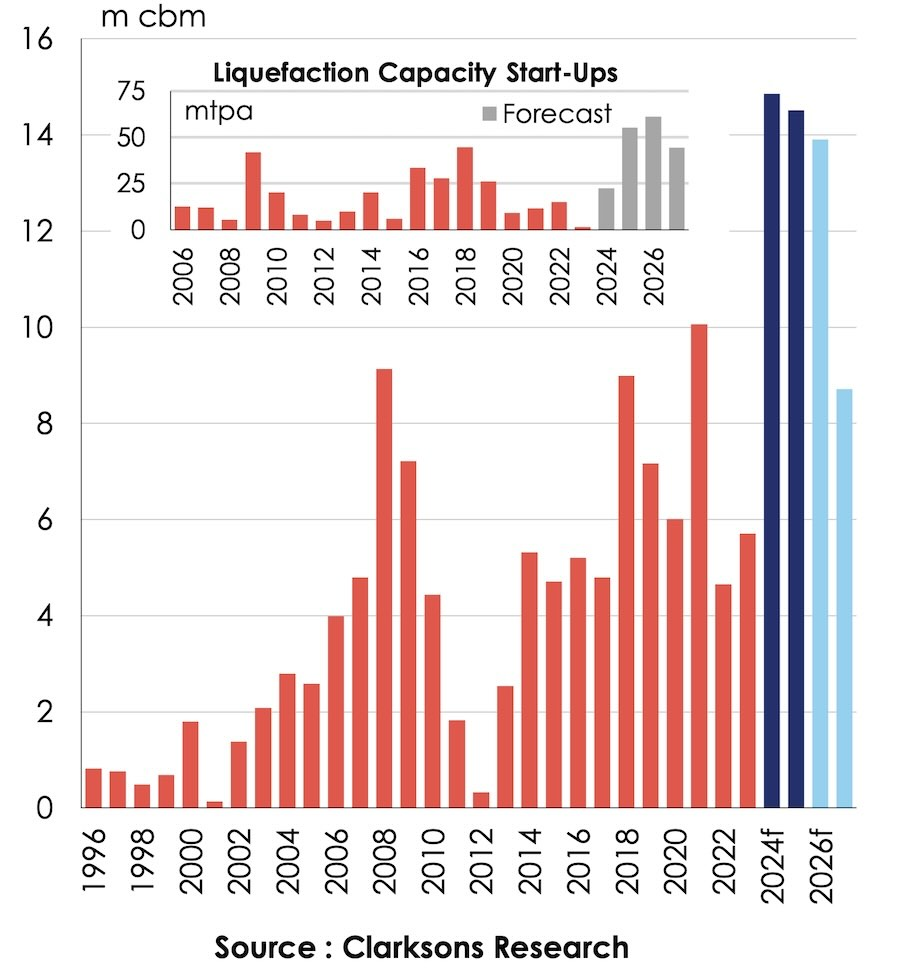

The pace of LNG newbuild deliveries will smash records this year, beating the previous annual gas ship delivery peak of 2021 by 48%.

Data from Clarksons Research shows 89 LNG ships – with a combined 14.9 cu m capacity – are due to deliver this year, more than double the 10-year average, representing a 48% increase on the current record of 10.1m cu m delivered three years ago.

Another year of very firm deliveries is expected in 2025, with 14.5m cu m initially projected to hit the water, while 131 vessels of 22.9m cu m are already on order for 2026-2027 delivery.

“With c.90% of vessels on order already committed to projects, although project slippage is always a risk, expectations remain for record start -ups and rapid trade growth across 2025-27 to absorb strong deliveries as the sector enters a major phase of expansion,” Clarksons noted in a recent weekly report.

Nevertheless, the Biden administration’s recent decision to temporarily halt new US LNG export approvals has injected “new uncertainty” into global gas markets, according to new analysis from Greek broker Intermodal.

With America emerging as the top LNG exporter in 2023 ahead of Australia and Qatar, the policy shift clouds projections of future supply, demand and price dynamics, Intermodal argued.

While currently operating US projects can continue to export, the pipeline of proposed export capacity will be stalled as the government reviews the climate and economic impacts.

“Shipping companies are possibly preparing for weaker long-term demand for tanker capacity, amidst a time when the orderbook to fleet ratio stands above 50%, and with the majority of them being delivered either this year or the next,” Intermodal noted.

Freight rates on the spot market to date this year have followed the seasonal pattern of the last five years, with rates peaking before winter and then softening.

Analysis from rival broker is SSY is initially bearish, but Red Sea exclusion could help prop up earnings.

SSY gas experts also point out that 2024 will see more attention paid to the new emissions regulations that have come into effect for the market with CII and EU ETS being key talking points for any chartering discussion.

“In these initial stages, the older steam turbine tonnage has begun to slow down (engine performance limitation systems are now commonplace), and this has impacted the desire to consider these ships as chartering options,” SSY noted in a recent report.

Concluding, SSY observed: “If the analysts are correct and the market looks to be weak over the next two years, then it is not a long period to wait, as the overriding sentiment from 2026 onwards is one of enormous positivity for LNG shipping.”