The renewal of the global shipping fleet made a significant stride in 2023, with a total of 539 ships, equivalent to 45% of all newbuild orders placed last year by gross tonnage, being capable of running on alternative fuels, Clarksons Research said.

“2023 was a hugely significant year in the shipping industries decarbonization pathway, with new regulation entering into force and a net zero commitment agreed at IMO. And while we remain only at the start of a vital and unprecedented fleet renewal investment program, a start has been made with 49% of current orderbook tonnage now alternative fuelled,” Steve Gordon, Global Head of Clarksons Research, said.

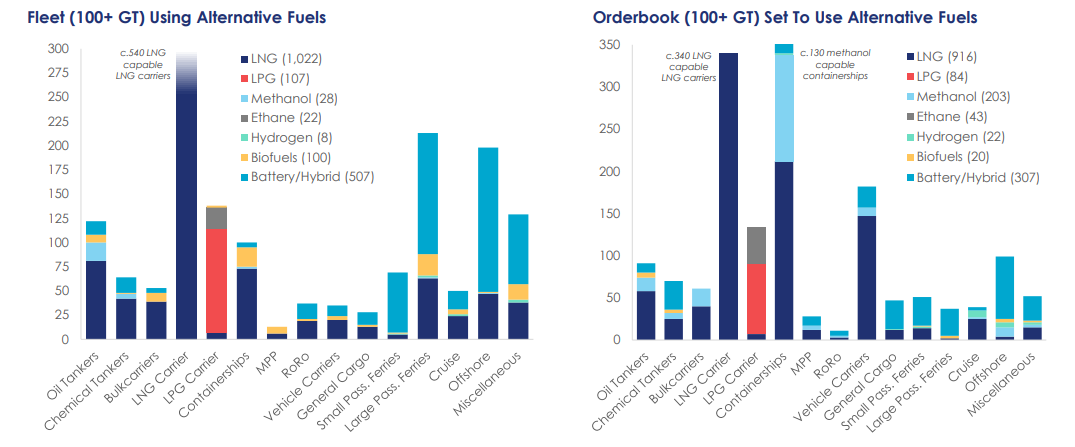

Clarksons’ data shows that the largest share of alternative-fueled orders in 2023 was still LNG dual fuel, albeit with an increase to 125 orders of methanol dual fuel vessels in 2023.

In 2022, a record ~55%* of all newbuild orders by tonnage (GT) were alternative fuel capable (basis non-LNG carriers: ~40% of tonnage). For context, in 2021 31% of newbuild tonnage ordered was for alternative fuel capable vessels, up from 27% in 2020 and 8% in 2016.

There were also 55 new orders involving LPG as a fuel and now 4 with ammonia.

The ordering includes 218 LNG capable ships of 18.9m GT (~25% of total ordering), 130 methanol capable vessels of 10.3m GT (13%), and 44 LPG capable vessels, while 121 units are set to be equipped with battery-hybrid propulsion.

Reflecting future “optionality”, there are 579 in fleet and newbuilds that have LNG “ready” status, 322 that are Ammonia “ready” and 272 that are Methanol “ready”.

Uptake of alternative fuels has continued to progress, with 6.0%** (start 2022: 4.5%, 2017: 2.3%) of the fleet on the water and 48.8% (start 2022: 33.6%, 2017: 10.9%) of the orderbook in tonnage terms capable of using alternative fuels or propulsion.

Of the total orderbook, 37.4% of tonnage is set to use LNG (916 units), 8.3% to use methanol (203 units), 1.7% to use LPG (84 units) and ~3.3% due to use other alternative fuels (~379 units) including hydrogen (8), ethane (43), biofuels (10) and battery/hybrid propulsion (~310).

With future optionality over fuel choice continuing to gain traction, there are now 444 LNG ready ships in the fleet and 135 on the orderbook, while there are 249 ammonia ready, 247 methanol ready and 14 hydrogen-ready vessels on order.

Take-up has also varied across shipping segments, with 83% of containership newbuild capacity ordered this year (rising to 94% including orders with “ready” status) and 79% of car carriers (98% including “ready” orders) ordered with alternative fuel capability but much lower shares in bulk carrier and tanker.

“Overall today, 6% of global fleet capacity is alternatively fuelled capable (up from 2.3% in 2017), which we project will increase to nearly a quarter of all fleet capacity by the end of the decade (2030(f):~23%),” Gordon added.

Data from Clarksons shows that there are other important developments, with “eco” vessels now constituting 32% of global tonnage on the water (as high as 50% in VLCC and Capesize) and the use of innovative Energy Saving Technologies (ESTs) continuing to expand.

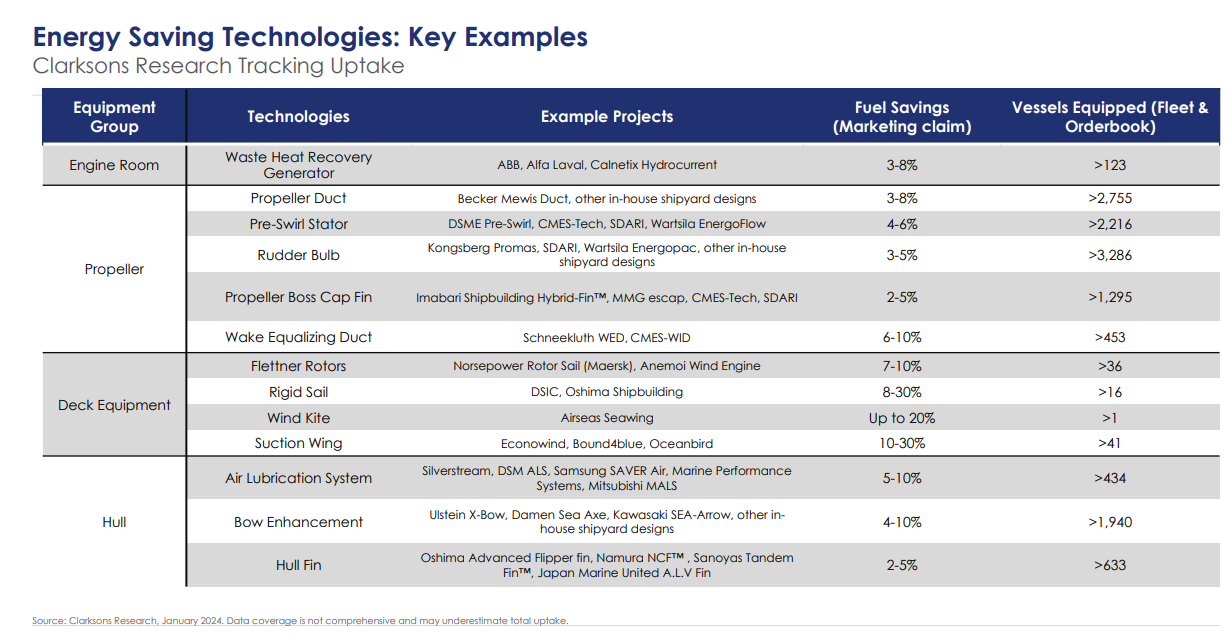

Energy-saving technologies have been fitted on over 7,295 ships, accounting for 29.5% of fleet tonnage: this includes propeller ducts, rudder bulbs, Flettner rotors, wind kites, air lubrication systems, and others.

These also include 47 vessels fitted with wind propulsion.

ETS installations will have significant implications for earning potential, asset values, and increasingly “tiered” and complex charter markets. For context, Clarksons estimates that 27.1% of global tonnage was ‘eco’ as of the start of 2022, and just 14.6% at start-2018.

“Our tracker also includes 31 in fleet vessels (plus 22 newbuidls) testing onboard carbon capture technology. With an ageing fleet (12.6 years, up from 9.7 years ten years ago) and our tracking of vessel performance under CII in 2023 suggesting over 30% of tonnage will be D or E rated, continued investment in the existing fleet will be critical,” Gordon noted.

“Our tracking of SOx Scrubbers has also increased y-o-y (totalling, including pending retrofits, over 5,590 vessels in the fleet, 27% of global fleet capacity) with 420 vessels retrofitted with a scrubber during 2023 and 321 newbuildings ordered with a scrubber. We also estimate that over 80% of global tonnage is now fitted with a BWMS.”

Price differentials between HSFO and VLSFO stand at ~$150/tonne in key ports, down from closer to $200/tonne earlier in 2023, according to Clarksons.

With that in mind, the average age of the world fleet is increasing, standing at 12.6 years on a GT weighted basis (up from a low of 9.7 years in 2013).

For the bulk carrier fleet, the average age is 12.0 years, for tankers it is 12.9 years and for the container fleet it is 14.2 years. Today, 32% of global tonnage is aged over 15 years.

Clarksons estimates that under CII, around 45% of today’s tanker, bulk carrier and container fleets will be D or E-rated if they are still trading in 2026 and have not modified speed or specification.

The overall orderbook as a % of fleet capacity remains historically moderate at ~11%, though with significant variation between sectors – the LNG carrier and containership orderbooks equal ~52% and ~25% respectively, while bulkers and tankers equal just ~9% and ~7%.

Finally, ‘green’ port infrastructure is continuing to expand: currently, there are 188 active LNG bunkering ports (and 82 planned facilities), while over 2,743 vessels in the fleet are fitted/set to be fitted with shore power connections.