The slowing trend in new shipbuilding orders is expected to continue into 2024 as the base effect of orders accumulated over the past two years continues to expand. The Export-Import Bank of Korea’s (KEXIM) Overseas Economic Research Institute pointed out that there is no clear demand factor for the new shipbuilding market in 2024, and the global new ship order book will continue to decline.

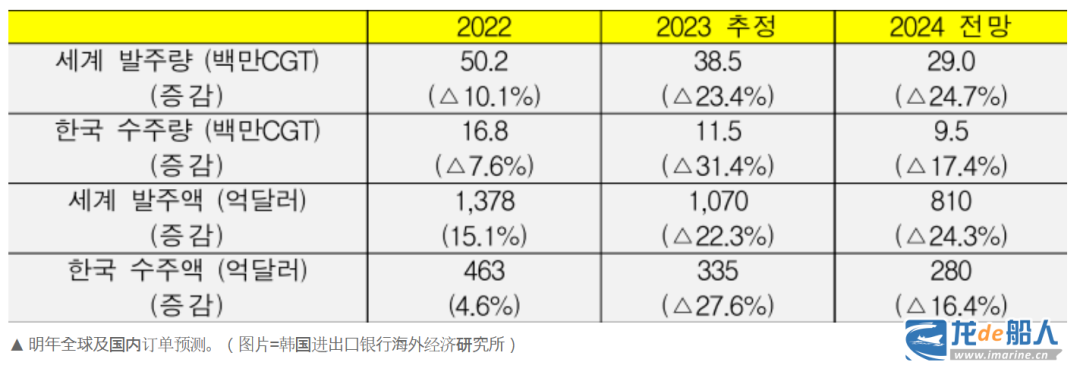

KEXIM Overseas Economic Research Institute speculates that the global new ship order book for 2023 is 38.5 million compensated gross tonnages(CGT), and is expected to decrease by 9.5 million CGTs in 2024 to 29 million CGTs. In the case of Korea’s shipbuilding industry, for example, the annual order book for 2023 is expected to be 11.5 million CGTs, and in 2024 it may drop to 9.5 million CGTs.

According to the data released by Clarkson in early December, from January to November this year, the global new ship orders totaled 38.09 million CGTs (1,545 ships), down about 20% from 47.77 million CGTs (1,811 ships) in the same period last year.This means that since the beginning of this year, new ship orders have been on a downward trend.

As of the end of November, the order book of Chinese shipbuilders this year stood at 22.09 million CGTs (973 ships), with a market share of about 58%, down 5% from the same period last year, while the order book of South Korean shipbuilders stood at 9.63 million CGTs (191 ships), with a market share of 25%, down 41% from the same period last year.

Although, global new ship orders have decreased, new shipbuilding prices remain strong. Clarksons data shows that the Clarksons Newbuilding Price Index stood at 176.61 points at the end of November, an increase of 14.92 points (9%) year-on-year, continuing the upward trend. However, the industry has mixed views on the prospects of the warming ship price wind. Some industry insiders believe that the downward trend will continue in the future as the newbuilding price cycle has now peaked, while others believe that it is too early to say that newbuilding prices have peaked.