Sea-Intelligence looked at the development in capacity market shares between the three carrier alliances on the Transpacific and Asia-Europe trades.

Capacity market share is the share of the total deployed capacity within each trade lane that is operated by each of the three carrier alliances, explains the Danish maritime data analysis company.

On Asia-North America West Coast, the alliances collectively lost capacity market shares especially during the pandemic, when capacity outside of the alliance structures was heavily deployed, according to Sea-Intelligence. Ocean Alliance regained their share in 2023, but 2M did not and is currently positioned lower than pre-pandemic. On Asia-North America East Coast, 2M lost much of the pre-pandemic gain, whereas both Ocean Alliance and THE Alliance also lost capacity market share compared to the same pre-pandemic period.

On Asia-Mediterranean, THE Alliance gained a bit of share during the pandemic and combined with the decline of Ocean Alliance, the two alliances are essentially evenly positioned behind 2M.

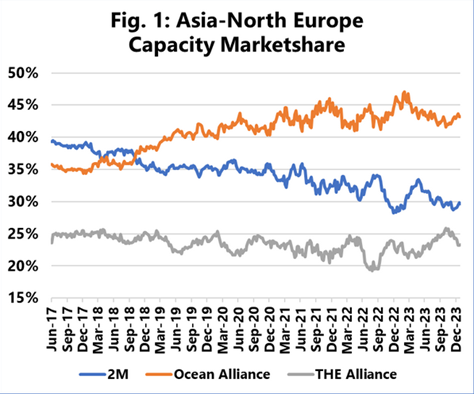

The most important change, however, is seen on Asia-North Europe. THE Alliance has maintained a relatively stable presence on the trade lane, across the entire analysed period. 2M however, has seen a constant erosion, which has been taken over by Ocean Alliance. This is a development taking place over essentially the entire period and is therefore not linked to the beginning dissolution of 2M. Essentially, CMA CGM, COSCO and Evergreen, have clearly gained position into North Europe, at the relative expense of Maersk and MSC.