In nominal dollar terms, newbuild prices are now just 8% shy of the all time record registered just a month ahead of the global financial crisis of 2008.

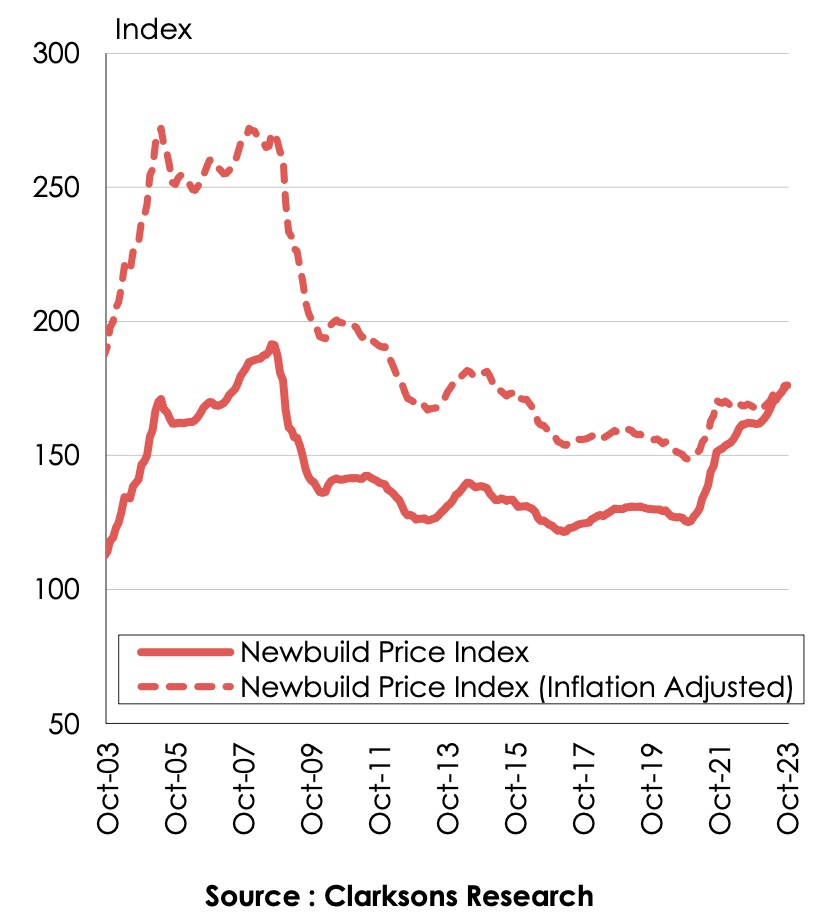

Clarksons Research’s Newbuild Price Index, which tracks a basket of prices across the main vessel types, reached 176 points at the end of October, up 36% since end-2020, up 9% versus the start of 2023 and the highest level since December 2008. As an inflation-adjusted index using today’s dollar value, the price index now is the highest since 2012, some 30% below 2008 peak price levels (see chart below).

Limited yard slot availability where forward cover today stands at 3.6 years, according to Clarksons, combined with general inflationary pressures for shipbuilders, including labour costs, have supported an upward trend in newbuild pricing.

Across the sectors, increases have varied, being most pronounced for VLCCs. A VLCC newbuild today costs $128m, up by 50% since the end of 2020.

Pricing has reached a deterring level for many ship types with analysts at Clarksons pointing out in the company’s most recent weekly report that a newbuild capesize costs equivalent to 24 years of today’s earnings after typical opex, compared to 12 years on average back in 2021.

Newbuild experts at another London brokerage, Gibson, have recently described the lengthy orderbooks in Asia, which now comfortably stretch into 2027, as well as how yards in China and South Korea are struggling to maintain their existing, heavy delivery schedules in light of labour pressures.

“We therefore do not see much realistic ability for yards in both Korea and China to significantly reduce pricing any time soon,” Gibson noted.

Newbuilding prices at post financial crisis highs are not necessarily enough to yield good returns for the yards, Pareto Securities pointed out in a recent report.

“Their input costs have come up a lot (on top of general inflation) and the lack of workers that has been talked about for years is now putting a true constraint on output,” Pareto observed.