Singaporean shipping company Vasi Shipping has initiated bankruptcy proceedings after container freight rates plummeted.

According to an announcement made by Vasi Shipping on April 10, the company plans to hold a creditors’ meeting on the 28th of this month, when a liquidator will be formally appointed and a list of creditors and the amount of their debts will be compiled.

Venkat Padmanabhan, director of Vasi Shipping, said in an interview that he could not give further details until the April 28 creditors’ meeting, but confirmed that the company was in serious difficulties due to high charter costs and low freight rates during the same period.

Padmanabhan, a long-time resident of Singapore and a veteran of Indian shipping with more than 40 years of experience, said helplessly: “Rents are high, but freight rates are falling all the way, which is completely contrary to the rules… This is how it is, and I have nothing to say.”

Data shows that container freight rates on many routes have been halved since the beginning of this year, but the charter market has risen due to the shortage of available vessels, forming a sharp gap.

According to the latest report from MB Shipbrokers, there were a large number of negotiations underway in the container market during the week ending April 11, with solid daily charter rates for vessels. So far in 2025, daily charter rates for almost all container ship types are above last year’s average.

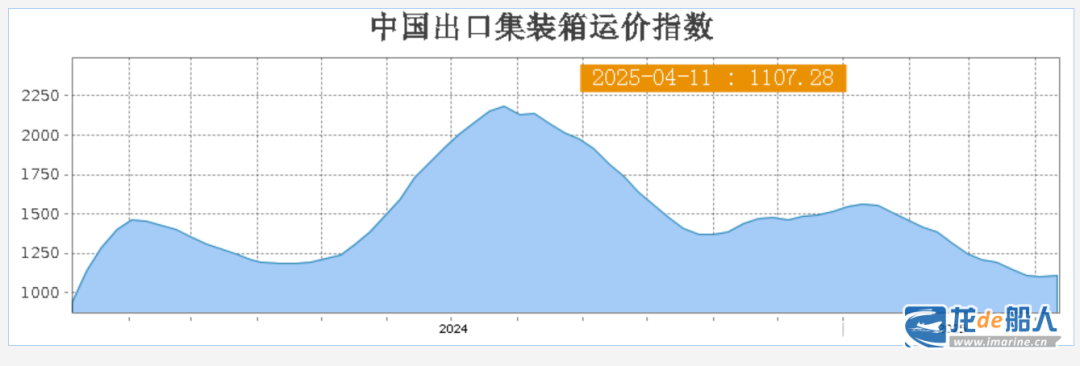

Earlier, BIMCO’s analysis showed that China’s average export container freight rate plummeted 28% in the first quarter of this year, the worst performance in nearly two decades. The China Containerized Freight Index (CCFI) plummeted from 1548 points at the beginning of the year to 1112 points at the end of the first quarter. The main reason for the decline was the sharp drop in spot market freight rates. The SCFI index, which tracks Shanghai export freight index, has fallen 46% so far this year, the largest first quarter drop since the index was established at the end of 2009.

Vasi Shipping owed creditors $19 million when it filed for bankruptcy, Linerlytica reported. Founded in January 2012, the company initially engaged in dry bulk chartering, primarily transporting fertilizer cargoes between China and India. Since 2014, the company has shifted to container feeder transportation, becoming more active during the COVID-19 pandemic.

By the end of 2022, the company operated between Singapore, Vietnam and Bangladesh. Since the beginning of March 2025, Vasi Shipping has ceased all vessel operations.

According to VesselsValue data, Vasi Shippingi previously owned two container ships, both of which have now been scrapped. One of them is the 1,730 TEU “Vasi Star” built in 1996, which was sold for dismantling in March 2023; the other is the 1,743 TEU “Vasi Sun” built in 1990, which was dismantled as early as December 2018.