Although there is still a possibility that the shipbuilding industry will see a new super cycle to replace the large number of ships delivered between 2005 and 2010, BRS Group, a well-known ship broker and consulting agency, predicts in its latest annual report that new ship orders will drop sharply in 2025 and new ship prices will stagnate.

“Even as new shipbuilding capacity comes online, shipyards will be hit by a slowdown in orders,” said Gilbert Walter, chairman and CEO of BRS. “The rest of the year will be just as unpredictable as the beginning of 2025 – the time is ripe for the asset play. Old ship values will continue to fall and newbuilding prices will stagnate.”

Regarding the shipbuilding industry, BRS noted that the average expected delivery date for shipyards’ available slots will be more than four years as of 2024. The tight supply of delivery dates has caused Chinese shipbuilders to embark on capacity expansion.

According to incomplete statistics, shipyards that have expanded capacity in China include: Yangzijiang Shipbuilding, New Times Shipbuilding, Wuhu Shipyard, Wison Clean Energy, Nantong Xiangyu Shipbuilding & Offshore Engineering Co., Ltd. (XMXYG SOE) , Bomaxco, COOECg, Jiangsu Hantong Ship Heavy Industry, etc. The shipyards that have restarted shipbuilding include: Dalian Shipbuilding Offshore Co. (DSOC), Hengli Heavy Industries, Xinjiangzhou Shipbuilding Heavy Industry, Sainty Shipbuilding (Yangzhou), Yangzhou Guoyu Shipbuilding, COSCO Shipping Heavy Industries (Guangdong), etc.

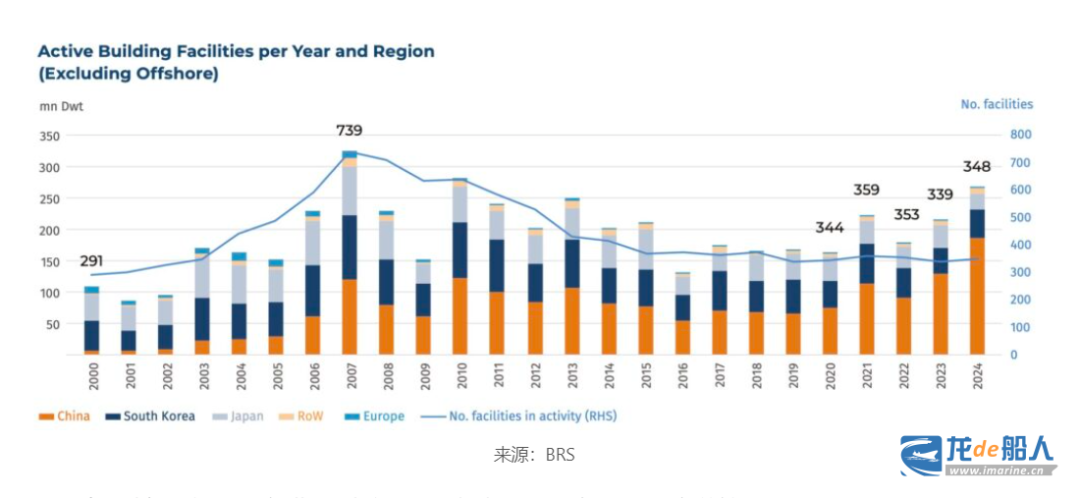

BRS predicts that after the expansion of Chinese shipyards is completed, it is expected that about 200 ships will be added to the global shipbuilding capacity each year, which means that the global shipbuilding capacity will increase from the current 1,500 to about 1,700. According to the agency’s data, there are currently about 348 operating shipyards in the world, which is about 50% of the approximately 700 active shipyards during the peak of shipbuilding in 2007.

BRS expects that Chinese shipyards are expected to add about 200 new ships per year to global shipbuilding capacity after completing their expansion, implying an increase in global shipbuilding capacity to about 1,700 ships from the current 1,500. Data from the agency shows that there are currently about 348 operating shipyards in the world, which is about 50% of the approximately 700 active shipyards during the peak of shipbuilding in 2007.

BRS believes that after 20 years, the global shipbuilding industry will enter a new round of “super cycle” starting in 2021. The last cycle was from 2003 to 2008. “We have held this theory for many years, based on the fact that during the 2003-2008 boom, global shipbuilding capacity increased from 1,483 ships per year (2005) to 2,591 ships (2010). The ships delivered during this period will be 20-25 years old by 2030, necessitating fleet renewal. At the same time, the ships built during the last supercycle were designed and built before the ecological revolution of the 2010s, meaning they need to be replaced with new, more efficient ships.”

In addition, BRS warned that uncontrolled expansion is one of the threats facing the global shipbuilding industry in the future, which may lead to market instability; whether the supply of engines can meet the demand of the new shipbuilding market is another uncontrollable factor faced by shipbuilders. The agency pointed out: “Major engine manufacturers are increasingly becoming a bottleneck for the delivery of new ships. shipbuilders can achieve preset production capacity targets through leasing and other means, and then provide shipowners with shipping schedules, but ships without main engines will not be delivered.”

BRS predicts that new ship orders will fall from 193 million DWT in 2024 to 100 million DWT in 2025, a drop of 48%. “Global uncertainty will continue, and new pressures in the freight market will delay investment decisions. The new round of shipbuilding expansion will have a downward impact on new ship prices. Depending on the type and specification of the ship, new ship prices will fall by more than 10% during 2025, although given the huge order volume, resistance still exists.”