On March 18, BIMCO, the largest direct entry membership organisation in the shipping industry representing almost 2,100 members and 63% of the global merchant fleet, filed comment on the U.S. 301 Investigations Against China’s Dominance in the Maritime, Logistics and Shipbuilding Sectors Act. Details are below:

For context, BIMCO has members in 130 countries, including the United States of America and the People’s Republic of China, who own, manage, operate or charter ships of all sizes in all sectors of merchant trade.

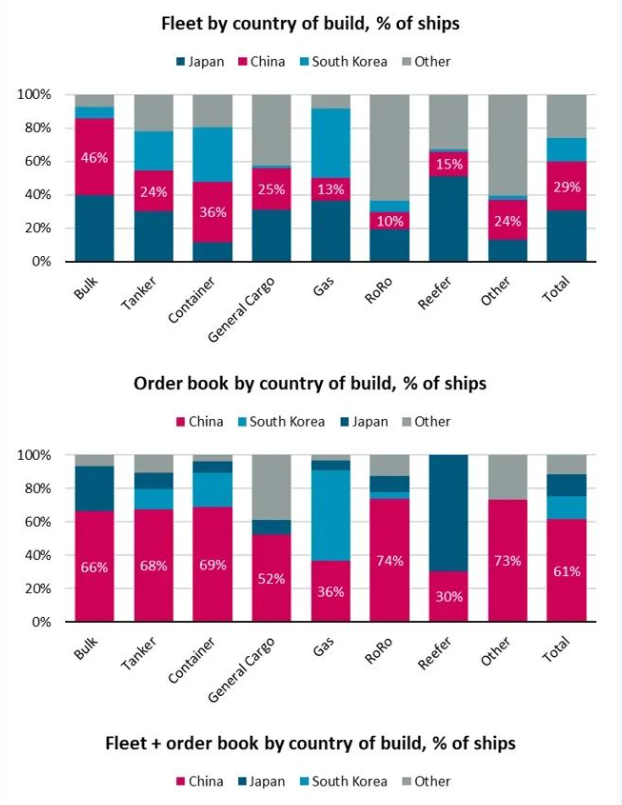

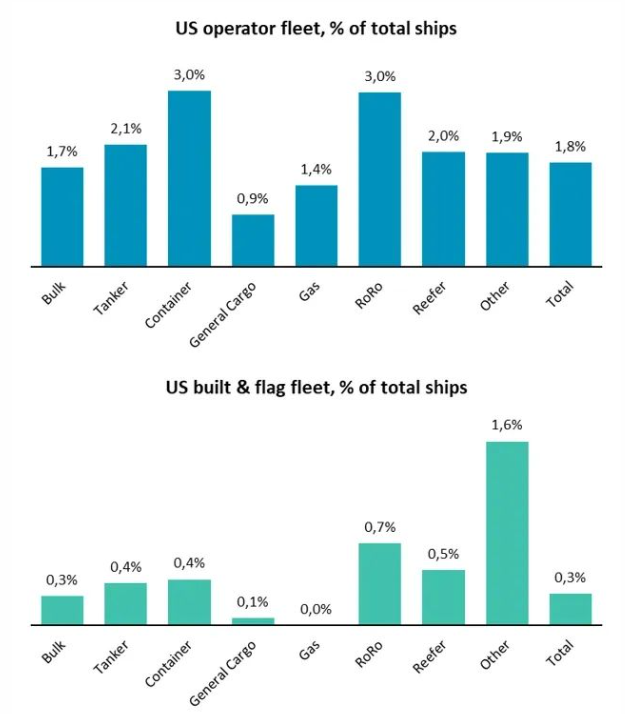

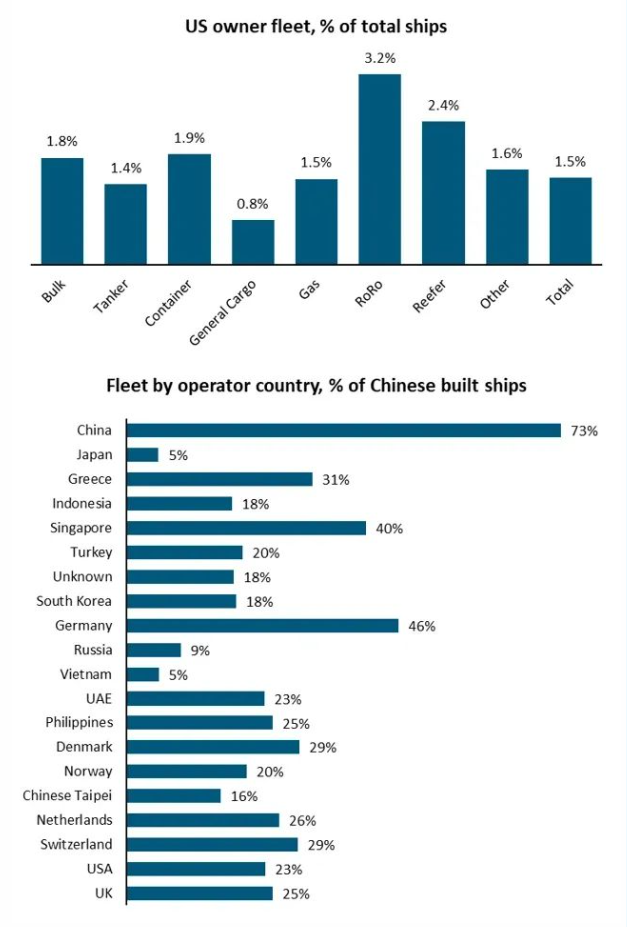

For decades BIMCO members have contracted the construction of new ships in a competitive international market where Asian shipyards have taken an increasing market share, particularly in China in recent years. The share of Chinese built tonnage1 of international operators’ fleets has increased in the last decade with less complex ship types being procured initially, followed by more complex ship-types.

Due to the very competitive nature of the international shipping market, the increase in cost-effective ships of Chinese origin has resulted in comparatively lower costs for maritime transport positively supporting world trade and global economies, including the United States of America.

The ships already built of Chinese origin will not disappear from the world fleet if the proposed port fees are introduced. If they had, it would have created a global shortage of tonnage serving the world’s transport needs and hyper-inflated shipping costs. Rather, the shipping industry will seek to avoid paying fees.

Charging fees on ships calling at US ports due to Chinese origin of the calling ships, Chinese domestication of the operator, the operator’s fleet’s percentage of Chinese origin ships and the operator’s order book’s percentage of Chinese contracts, will significantly increase the cost of seaborne transport to and from the United States of America – even if operators are pursuing avoidance strategies.

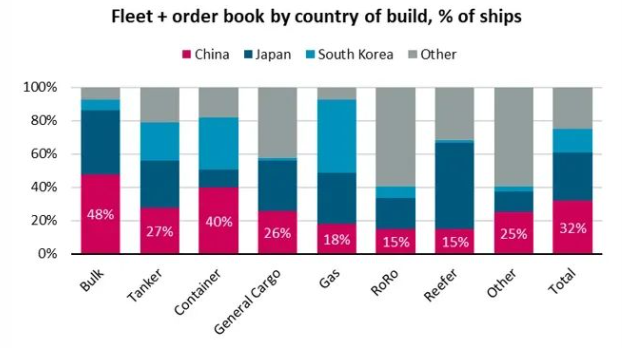

We expect operators will react and seek to avoid the negative effects of such port fees on their business. Most operators in the world have in their fleet one or more ship(s) of Chinese origin meaning that when calling at a US port, they would be subject to a port fee. Port fees are passed on in the supply chain so the costs would be passed on to the US importers of foreign goods and, ultimately, the US consumer. We note that the second option of port fees for ships operated by Chinese operators is likely prohibitive for continued trading to US ports. A fee of USD 1,000 per net tonnage on, for example, a 300,000 DWT super tanker is more than USD 100 million per port call.

If the proposed fee structure is implemented as drafted, seaborne trade to and from the United States of America will become less efficient and less economically viable. It is likely that some operators would shy away from having Chinese tonnage in their fleets and dedicate their maritime operations towards the US market. Other operators might do the opposite, increasing their share of Chinese tonnage and dedicating their maritime operations to non-US trade. The totality of the world fleet would not change, but the overall cost of maritime trade would increase due to less competition in the now segregated US market. In this regard it is worth keeping in mind that US import/export is about 12% of global seaborne trade so the consequences of re-organising maritime trade will have a much bigger impact on US import/export than on trade in the rest of the world.

While a macro analysis points towards avoidance, some sectors are more adaptive than others. In this regard the container shipping sector with relatively few, very large operators may be less prone to market segmentation and rather seek to minimise the number of port calls in the US per ship. This will inevitably lead to port congestion, trade flow chocking and increased inland re-distribution need. Fewer port calls will also have negative impact on port jobs with some ports becoming potentially unattractive for foreign trade.

Higher transport cost for US imports of raw materials will, due to such commodities’ relative low value, be impacted much more than higher value import goods. This effect runs counter to other stated objectives of the US Administration, such as increasing production domestically with its associated need for more raw materials.

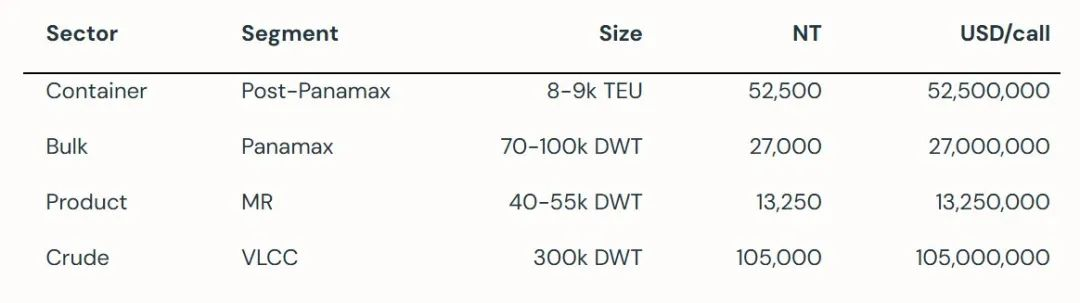

A section of the proposed actions pertains to US export. In this regard we note the desire to stimulate the construction and operation of US built, US flagged ships. So far, such activity has been limited, primarily serving domestic US transport as required under the Jones Act.

We note, however, that the tonnage5 presently available to fulfil the proposed export requirements are limited in numbers, size and types. Few maritime operators, if any, will be able to document that their annual, per calendar year, share of US export will meet the required 20% to be carried on US built, US flagged ships. This effectively means that little, if any, US export could be undertaken post implementation, not least energy export, specifically liquid natural gas (LNG) as no US built, US flagged LNG carriers are in operation nor on order. The US chemical industry’s access to vital export markets will also be severely impeded.

Whether or not a requirement to carry US export on US built, US flagged ships in the future is realistic is beyond the scope of these comments. US shipbuilding has not been competitive6 for a long time, witnessed by the lack of US built tonnage in the world fleet. However, we note that if it is required to carry US export on US built, US flagged tonnage, and that such tonnage is becoming available, the transport cost would increase significantly and impact US export’s competitiveness on the world market. This is especially true for low value commodities such as grain and soy.

In summary, the proposed actions will impose much increased transport costs on US imports and exports and have negative effects on the wider US economy; their impact on Chinese dominance is much less certain.