The latest economic figures on the state of German merchant shipping, presented today by the German Shipowners’ Association (VDR) at its annual press conference, underscore an important fact: Despite geopolitical turbulence and uncertain times in international trade policy, German shipping remains a reliable guarantor of economic strength and supply security for the Federal Republic. Around 62 percent of German exports and 60 percent of imports are handled by sea—clear evidence of how essential a functioning maritime trade and a competitive merchant fleet are for the survival of our export-driven nation.

Strong Performance in Uncertain Times

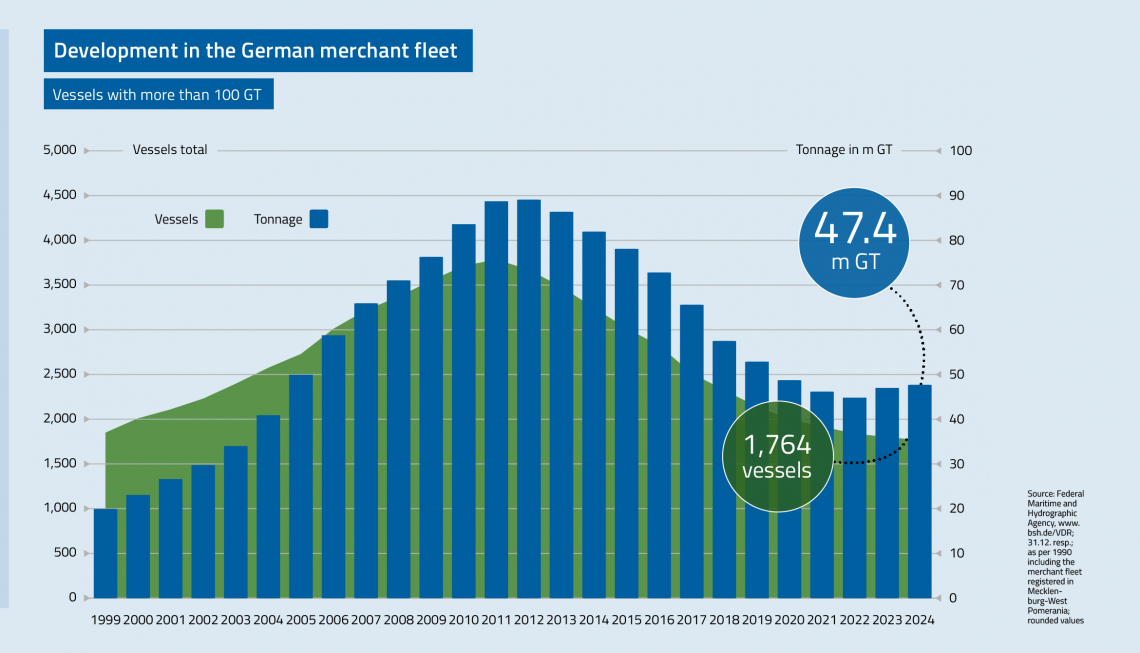

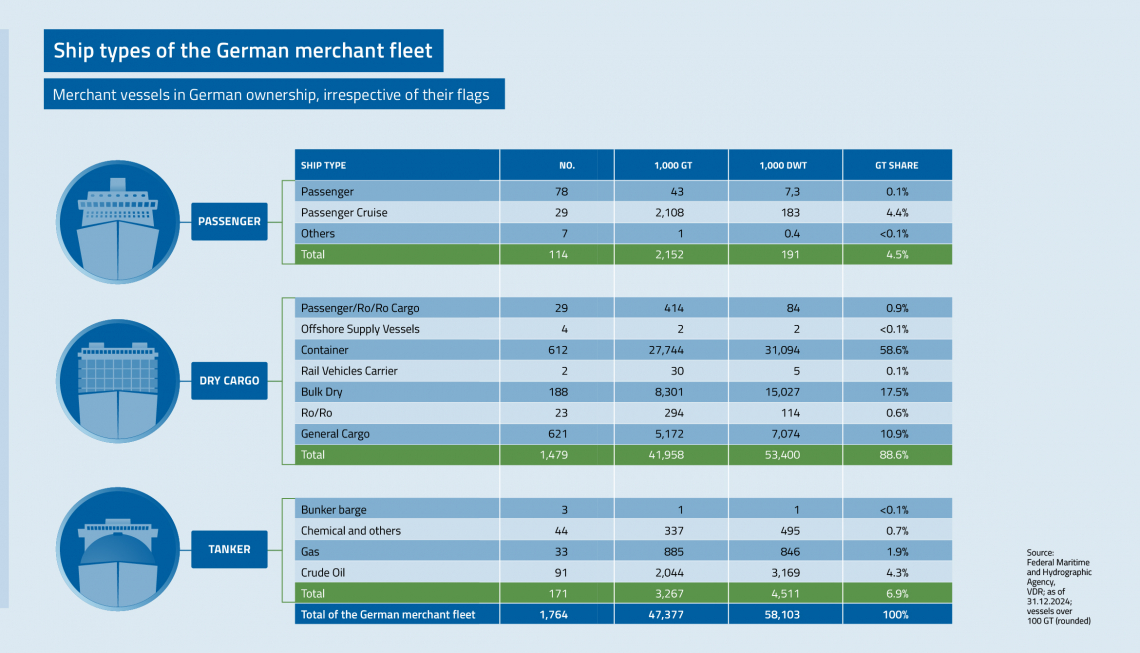

The figures are impressive: With nearly 290 shipping companies based in Germany, a fleet of 1,764 ships, and a gross tonnage (GT) of 47.4 million, Germany once again ranks seventh among the world’s leading merchant shipping nations this year. Germany’s merchant fleet secures around 500,000 jobs in the maritime industry and serves as a vital transport link in times of crisis, ensuring the supply of essential goods, raw materials, and energy to the Federal Republic.

VDR President Gaby Bornheim emphasizes: “Without a strong and independent merchant fleet, there is neither economic stability nor national security—especially in times when geopolitical and trade policy risks are steadily increasing.”

Between Geopolitical Crises and Protectionist Shifts

Rising tensions along key international maritime trade routes—from the South China Sea and the Taiwan Strait to the waters surrounding the Black and Red Seas—are not only disrupting global maritime trade but also posing a significant risk of attacks on German merchant ships and blockades of critical sea lanes for German imports and exports.

The VDR warns that national interests must not come at the expense of free global trade flows. Additionally, increasing protectionist tendencies in global trade policy present challenges for German shipping. Higher tariffs and restrictive measures aimed at shielding national markets result in disrupted supply chains and rising transport costs. For shipping companies, this translates not only into potentially longer trade routes and higher operational expenses but also considerable planning uncertainty in global goods transportation.

These challenges are further intensified by recent protectionist announcements from the United States. The introduction of 25% tariffs on European goods, as announced by President Trump, as well as the U.S. plan to impose multi-million-dollar fees on China-built ships when entering U.S. ports, are causing significant uncertainty in the German and global merchant fleet. At the same time, it can no longer be ruled out that the U.S. government may increasingly withdraw from security commitments. Thus, the need for Germany to secure its own supply in the long term is also growing. As a strategic response to the changing global trade and security architecture, it is essential to strengthen its own merchant fleet and ensure its continued existence.

“As a leading export nation with scarce natural resources, we rely on secure and open trade and shipping routes. A consistent national maritime security strategy, enhanced naval presence, and closer cooperation between security authorities and the merchant fleet are essential. Security comes at a cost—hesitation costs even more,” warns VDR CEO Martin Kröger.

Germany’s Competitiveness in an International Comparison

Although Germany remains a strong maritime hub, international comparisons reveal challenges: In container shipping, Germany (30.2 million GT) now ranks third behind Switzerland (34.7 million GT) and China (31 million GT)—a clear sign of the intense competition on a global scale. The VDR therefore calls for targeted, long-term measures to strengthen the competitiveness of German shipping companies and Germany as a maritime location to avoid falling behind internationally.

“The international competition among merchant fleets and shipping hubs is intense and dynamic, with increasing pressure. We must secure the competitiveness of our German merchant fleet in the long run and consistently support our maritime SMEs,” urges Kröger.

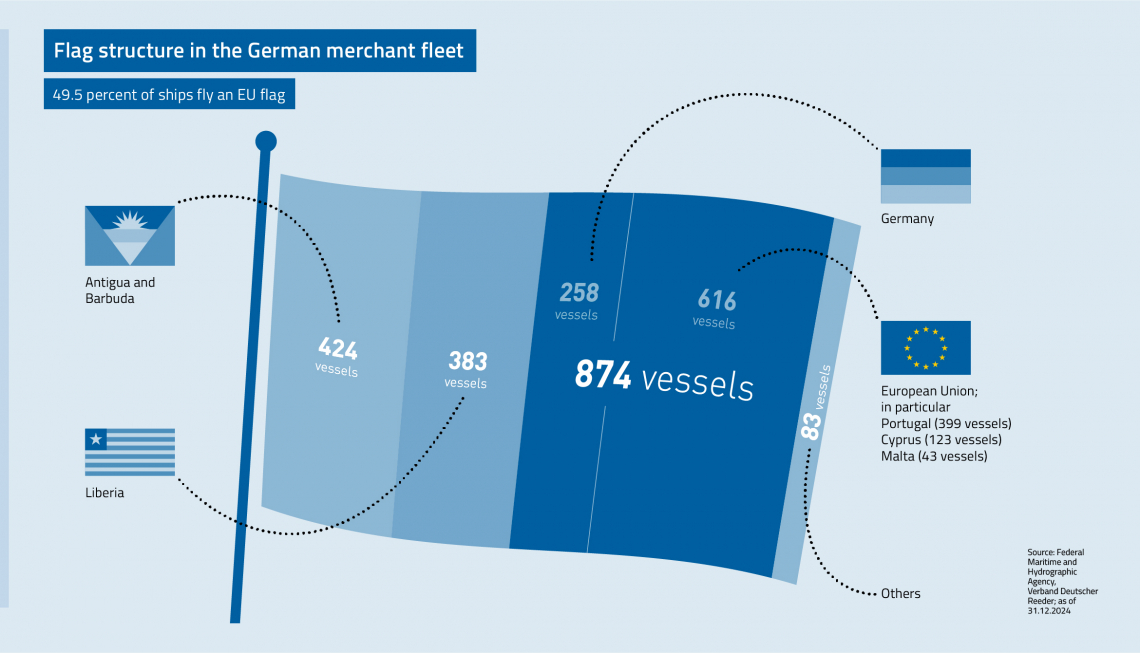

The majority of German shipping companies are medium-sized businesses. Eighty percent of them operate fewer than ten ships. Every second ship in the German merchant fleet sails under the flag of an EU country, particularly Germany and Portugal.

Positive Boost for Young Talent

A particularly encouraging development: Training numbers in the shipping industry have risen by a remarkable 14 percent in 2024. With 499 new training contracts at sea (previous year: 418) and 214 onshore (previous year: 208), it is evident that more young people are recognizing the diverse opportunities and future prospects in shipping. This is a crucial factor in securing maritime expertise, strengthening Germany as a shipping hub, and advancing the industry’s transition to climate neutrality.

“Shipping needs visionary and motivated young professionals who not only want to actively shape the future of the industry but also take the decisive step toward a climate-neutral era with us. It is incredibly encouraging to see more and more young talents recognizing the enormous opportunities in shipping and enthusiastically taking on this challenge,” says Bornheim.

Bureaucracy Hinders Growth

In addition to geopolitical and trade policy uncertainties, German shipping companies face an increasingly dense administrative burden within Europe. Double reporting requirements and regional special regulations on climate protection unnecessarily complicate ship operations and weaken competitiveness.

“It is high time for Europe and Germany to abandon their dubious leadership in excessive bureaucracy and regional special regulations. Streamlined processes and globally consistent climate protection requirements are essential to safeguard Germany’s economic strength at sea,” says Kröger.