South Korea domestic ship engine manufacturers are increasing investments in expanding production facilities as work orders flood in amid a boom in the shipbuilding industry, according to South Korea Media ChosunBiz.

According to the shipbuilding industry on the 11th, Hanwha Engine has signed ship engine supply contracts worth approximately 845.2 billion won over the past two months this year. This amount is half of last year’s record annual order of 1.65 trillion won.

Following an order for ship engines worth 629.2 billion won in January, Hanwha Engine secured an additional engine supply contract worth 216 billion won on the 5th of this month. The client is only identified as being in Asia, but the shipbuilding industry estimates that it is for orders from Chinese shipyards. As Chinese shipyards are booked with shipbuilding orders until 2029, further engine orders are anticipated.

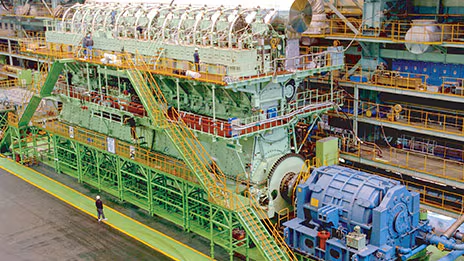

As orders for engines pour in, Hanwha Engine has recently decided to invest in new facilities for production equipment. By September next year, it plans to invest 80.2 billion won in its Changwon business site to expand production capacity. Hanwha Engine has been continuing expansions to increase its dual-fuel engine production capacity since acquiring HSD Engine in 2023. Currently, Hanwha Engine’s engine production capacity is about 130 units, and it is reported to focus on enhancing its capacity to manufacture large dual-fuel engines.

HD Korea Shipbuilding & Offshore Engineering is restructuring the engine business between HD Hyundai Heavy Industries and HD Hyundai Marine Engine following the inclusion of HD Hyundai Marine Engine in the second half of last year. After completing the acquisition of the former STX Heavy Industries (now HD Hyundai Marine Engine) in July of last year, it is shifting medium engine work to affiliates. HD Hyundai Heavy Industries will focus on large engine production while HD Hyundai Marine Engine handles medium engines for HD Hyundai Mipo. During the STX Heavy Industries era, HD Hyundai Marine Engine was strong in medium engine production, competing with HD Hyundai Mipo.

HD Hyundai Marine Engine is currently investing in facilities and improving equipment as it accelerates the recovery of its operational rate. It plans to gradually increase its current operational rate of 40% to 100%. Earlier in January, it also secured a contract to supply ship engines worth 37.2 billion won to Samsung Heavy Industries.

Domestic engine manufacturers are targeting the field of eco-friendly ship engine maintenance and repair services. With the increasing demand for eco-friendly dual-fuel engines, they aim to grow long-term service agreements (LTSA) as a new revenue stream.

At the end of last month, Hanwha Engine signed a long-term service agreement (LTSA) contract worth 19.6 billion won with domestic shipping company Pan Ocean. This contract involves maintenance and repair work for 27 ship engines supplied to Pan Ocean over five years.

This contract is the first secured by Hanwha Engine since it was established from HSD Engine in February of last year. Hanwha Group has made a full-scale entry into the ship engine LTSA business through investments in personnel and facilities after acquiring HSD Engine. During the HSD Engine era, there was only one LTSA contract performance. As environmental regulations on ships have tightened, the use of dual-fuel engines capable of using eco-friendly fuels such as liquefied natural gas (LNG) and methanol has been increasing, leading to higher demand for LTSA.

A representative from Hanwha Engine noted, “We have confirmed the demand for LTSA services, as shipowners who have long been accustomed to diesel engines find managing dual-fuel engines unfamiliar and challenging, and we intend to actively enter the market.”