U.S. President Donald Trump’s plan aimed at revitalizing the U.S. shipping industry could impose huge costs on maritime operators and trigger a new round of disruption in global supply chains, several business executives said, according to Reuters.

The U.S. plans to impose U.S. port call fees on all fleets containing Chinese-built or Chinese-registered ships, according to a draft executive order obtained by Reuters on Feb. 27, and has urged allies to take similar measures or face retaliation.

The administration of U.S. President Donald Trump is drafting an executive order aimed at revitalizing the domestic shipbuilding industry and undercutting China’s dominance of the global shipping industry. The draft executive order proposes to impose fees on all ships entering U.S. ports “regardless of their place of construction or registration, provided that the fleet to which the ship belongs includes Chinese-built or Chinese-registered ships.” According to the draft, the U.S. would also impose tariffs on Chinese cargo-handling equipment.

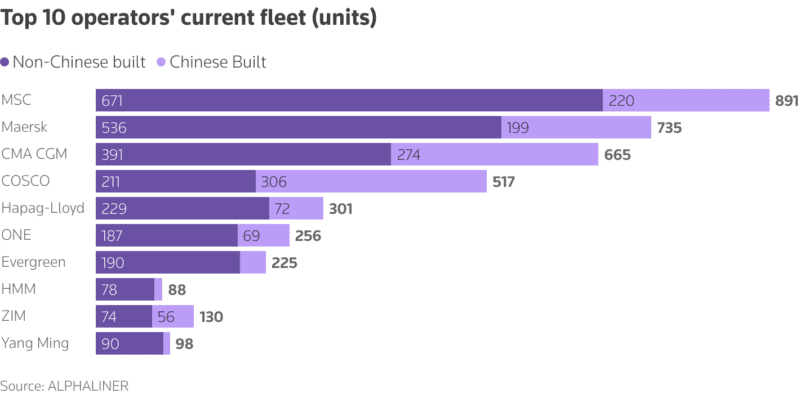

The draft does not specify the amount or calculation method of the fees, but it could potentially cause significant losses to major container carriers, including Switzerland’s Mediterranean Shipping Company (MSC), Denmark’s Maersk, Germany’s Hapag-Lloyd, and Taiwan’s Evergreen Marine, as well as ship operators transporting food, fuel, and automobiles.

The World Shipping Council (WSC), which represents the international liner shipping industry, noted that this port fee policy could affect virtually all ships calling at U.S. ports, adding up to $30 billion in annual costs to U.S. consumers and doubling the cost of shipping U.S. exports. WSC CEO Joe Kramek said, “Policymakers must reconsider these damaging proposals and seek alternative solutions that support U.S. industry.”

While the stated goal of Trump’s plan is to revitalize the sluggish U.S. shipbuilding industry and undermine China’s dominance in global shipping, pessimistic expectations among industry executives suggest that this Trump’s U.S.-friendly policy could have unintended consequences that run counter to his goals.

Jeremy Nixon, chief executive of containership owner Ocean Network Express (ONE), said at the S&P Global TPM Container Shipping Conference in Long Beach, California this week that the plan was a “curve ball” that could cause serious damage to ocean carriers and their customers.

In the short term, shipowners may reduce the number of calls at U.S. ports to avoid the costs. Executives warned that large amounts of extra cargo could clog ports, making it harder for imports to reach retailers, while exports from U.S. manufacturers would struggle to be loaded for shipment.

In addition, Trump’s plan could force companies to redeploy their global fleets to focus non-Chinese-built ships to serve the U.S. market – an adjustment that could be time-consuming and costly.

To mitigate the impact, MSC, the world’s largest container carrier, may skip smaller ports such as the Port of Oakland, California, a key gateway for U.S. fresh beef, dairy and almond exports, Chief Executive Soren Toft said at the TPM conference.

Executives warned that such moves could lead to overloading of large U.S. ports and marginalization of smaller ones, and possibly even a repeat of the disruption of global trade flows in the early days of the epidemic.

Beth Rooney, head of the Port of New York and New Jersey, the largest port on the U.S. East Coast, said: “It is difficult for us and our partners to absorb such a huge surge in cargo volume at one time.”

Commenting on the costs associated with Chinese-built ships, MSC’s Toft said, “If regulations are introduced, they should at least be forward-looking and not penalize us for unknown past mistakes.”

Meanwhile, French container carrier CMA CGM is expanding its U.S.-flagged American President Lines (APL) fleet and exploring shipbuilding in the U.S. CMA CGM has established a vessel-sharing alliance with COSCO Shipping and counts retail giant Walmart as a major customer. “We are in talks with several shipyards to evaluate the time and cost,” CMA CGM CEO Rodolphe Saadé revealed in an interview on Friday.

Denmark’s Maersk said it was too early to comment on new tariffs or fees as policies were changing rapidly and had not yet been finalized.