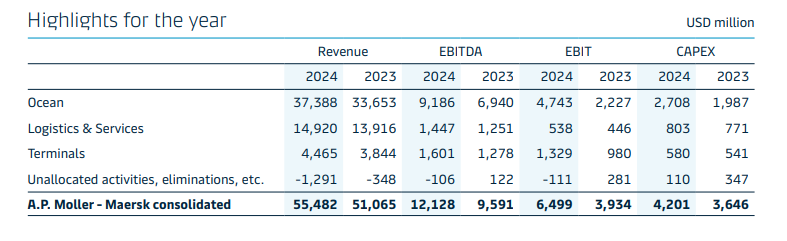

On February 6, Maersk announced its 2024 financial report. Maersk achieved impressive results in 2024, with growth in all business segments and significant profit increases. Earnings before interest and taxes (EBIT) grew by 65%, reaching $6.5 billion.

This achievement was driven by several factors, including increased demand for ocean freight services and higher freight rates, increased terminal business revenue and volume, and improvements in most logistics products. Based on strong performance and a robust financial position, the board proposed a dividend of 1,120 Danish kroner per share.

Additionally, they announced a share buyback plan of approximately $2 billion, which is expected to be completed within 12 months.

CEO of A.P. Møller – Mærsk A/S, Vincent Clerc, states: “Our ability to navigate shifting circumstances and ensure steady supply chains for our customers was put to the test throughout 2024. Our efforts were rewarded with record-high customer satisfaction. We successfully capitalized on increased demand while enhancing productivity and rigorously managing costs – all of which contributed to our strong financial performance. With three strong businesses – Ocean, Logistics, and Terminals – plus integrated offerings across the supply chain, we are uniquely positioned to support our customers in an era where geopolitical changes and disruptions continue to reinforce the need for resilient supply chains”.

The profitability of the ocean freight business improved compared to last year, thanks to a significant increase in freight rates caused by the situation in the Red Sea and high cargo volumes. High capacity utilization and cost control optimized ocean freight operations, ensuring the company’s ability to handle uncertainties. Operating costs remained stable year-on-year, offsetting the increased costs and fuel consumption due to the detour around the Cape of Good Hope.

The logistics business has shown resilience, making steady progress every quarter and achieving higher volumes, revenues and EBIT margins compared to 2023. Logistics revenue increased by 7%, mainly due to solid growth in the warehousing, air freight and first-leg multimodal product categories. At the same time, upgrades in most products also led to improved profitability.

The terminal business achieved its best financial performance ever, with EBITDA and EBIT reaching record highs. The significant increase in annual revenue was primarily driven by the following factors: growth in cargo volumes, increased rates offsetting inflation, a higher quality customer and product mix, and increased storage income.

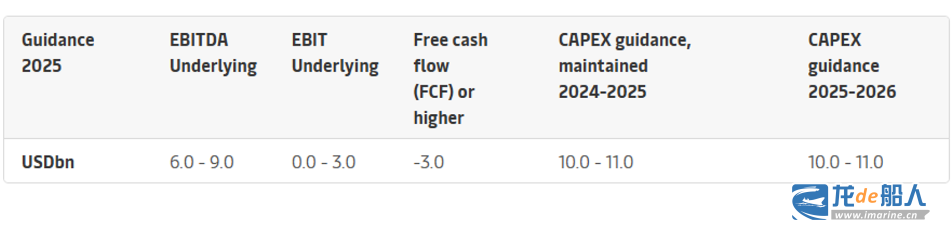

2025 Financial Performance Guidance

We have set our 2025 financial guidance based on the expectation that global container volumes will grow by approximately 4% in 2025 and that Maersk will grow in line with the market. A larger supply-demand imbalance is expected in 2025, due to continued new ship deliveries in the container shipping industry and the potential reopening of the Red Sea.

However, this imbalance is likely to be largely offset by supply-side drivers and strong market demand. For the purpose of financial forecasting, Maersk assumes the Red Sea reopens in the middle of the year at the low end of the guidance range and at the end of the year at the high end. Maersk’s outlook for 2025 is significantly affected by macroeconomic uncertainties that could impact container volume growth and freight rates.

Total shareholder return

In 2024, Maersk returned $1.6 billion to shareholders through dividends and share buybacks. The spin-off and divestment of Svitzer returned $1.1 billion to shareholders in the form of in-kind dividends.

In February 2024, the board of directors decided to suspend the share buyback program and stated that they would reassess the plan once the ocean freight market stabilized. The board has now decided to launch a share buyback program of up to 14.4 billion Danish kroner (approximately $2 billion), to be completed within 12 months.

Full-year performance highlights

Factors affecting performance

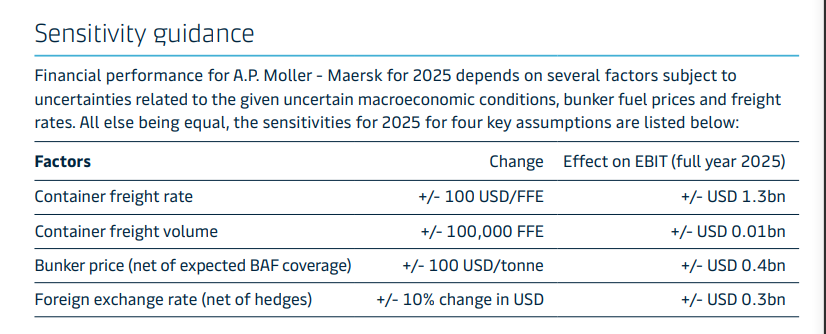

Maersk’s financial performance in 2025 is affected by uncertain factors such as macroeconomics, fuel prices, and freight rates. Under the same conditions, the impact of the four core factors on profits is as follows: