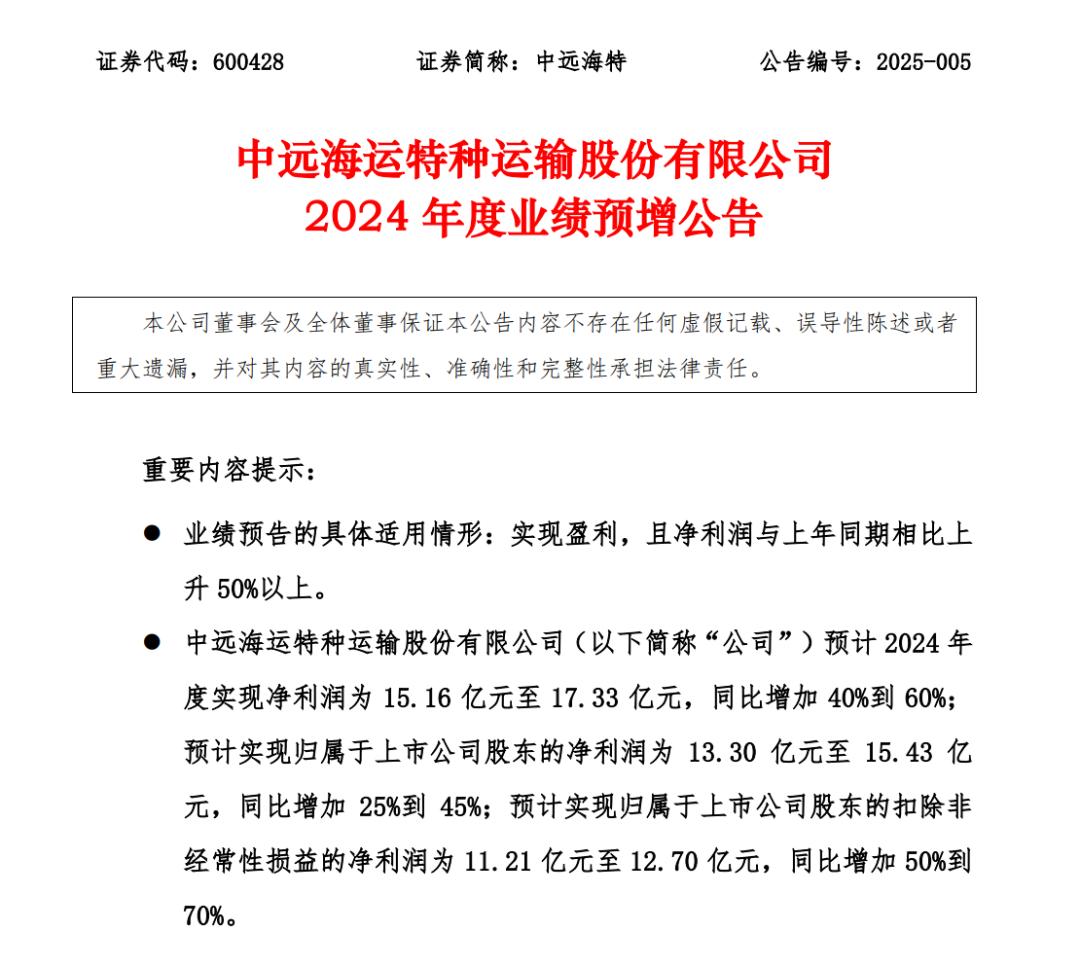

On January 27, COSCO SHIPPING Specialized Carriers issued an announcement on the expected increase in performance for 2024, predicting that the net profit in 2024 will increase by more than 50% year-on-year.

The announcement shows that COSCO SHIPPING Specialized Carriers expects to achieve a net profit of RMB 1.516 billion to RMB 1.733 billion in 2024, a year-on-year increase of 40% to 60%; it expects to achieve a net profit attributable to shareholders of the listed company of RMB 1.330 billion to RMB 1.543 billion, a year-on-year increase of 25% to 45%; it expects to achieve a net profit attributable to shareholders of the listed company after deducting non-recurring gains and losses of RMB 1.121 billion to RMB 1.270 billion, a year-on-year increase of 50% to 70%.

During the same period in 2023, the Company realized net profit of RMB 1,083 million, net profit attributable to shareholders of listed companies of RMB 1,064 million, net profit attributable to shareholders of listed companies after extraordinary gains and losses of RMB 747 million, and basic earnings per share of RMB 0.496.

The core drivers of earnings growth are:

1.Strong performance in the main business:

- Improved industry environment: In 2024, the supply and demand structure of global maritime trade will improve, and the overall prosperity of the shipping market will increase. As a leading enterprise in the field of special transportation, COSCO SHIPPING Specialized Carriers has seized this market opportunity by virtue of the expansion of its fleet size and the improvement of its service capability.

- Business structure optimization: The company deepened the “14th Five-Year Plan” strategy, clarified the positioning of “overall solution service provider”, and focused on serving the new energy industry and supporting China’s manufacturing exports. At the same time, it enhanced operational efficiency through measures such as the layout of hub channels and the optimization of route configuration.

- Innovation and Sustainable Development: COSCO SHIPPING Specialized Carriers continues to promote its digital transformation and green development strategy, enabling the company to further consolidate its position in the industry while enhancing its profitability.

2. Supported by non-recurring gains: The company recognized RMB 120 million in equity disposal gains through a merger of companies under non-identical control. In addition, this strategy optimized asset management and laid a solid foundation for future growth.

3. Limited impact of asset impairments: Although the company made asset impairment provisions of approximately $354 million due to changes in the TOTAL lubricants market, this impact was offset by other growth factors and did not pose a significant threat to the overall trend of the earnings forecast.

From the content of the announcement, COSCO SHIPPING Specialized Carriers continues to make great efforts in its core businesses such as new energy logistics support and bulk material transportation guarantee, which fully reflects its deep understanding of the changes in the global supply chain.

In the future, the company will face a more complex market environment and potential challenges, including changes in the international trade landscape and higher carbon emission requirements. However, with its sound development strategy and continuous investment in technology, the company is expected to capture a larger share of the global specialty transportation market.