On January 22nd, China National Offshore Oil Corporation (hereinafter referred to as “CNOOC” or “the Company”) announced its business strategy and development plans for 2025.

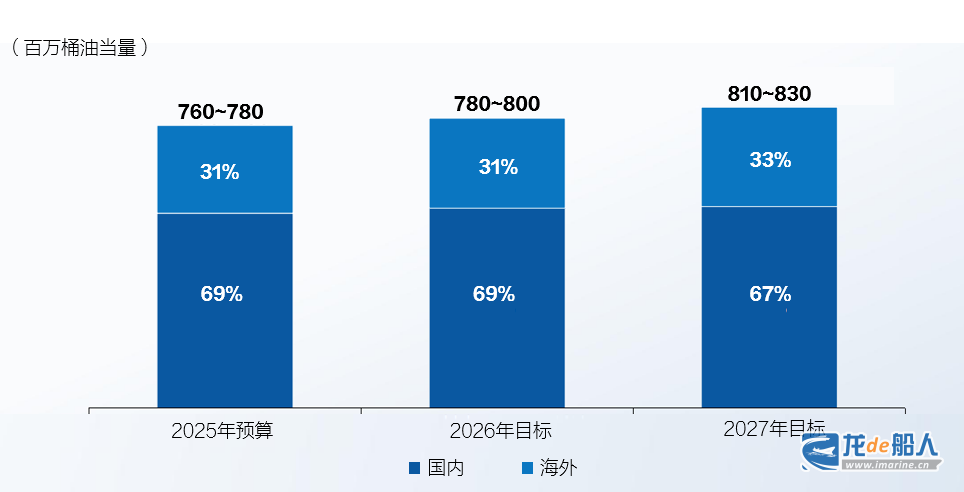

In 2025, the company’s production will continue to grow, with daily net production exceeding 2 million barrels of oil equivalent. The annual net production target is set at 760 to 780 million barrels of oil equivalent, with approximately 69% from domestic production and 31% from overseas. For 2026 and 2027, the company’s net production targets are 780 to 800 million barrels of oil equivalent and 810 to 830 million barrels of oil equivalent, respectively. The company’s net production for 2024 is expected to reach approximately 720 million barrels of oil equivalent, marking six consecutive years of record production highs.

The company will maintain stable capital expenditures. In 2025, the company’s total capital expenditure budget is expected to be between RMB 125 billion and 135 billion. Capitalization for exploration, development, and production is expected to account for approximately 16%, 61%, and 20% of the total capital expenditure budget, respectively. The company’s capital expenditure for 2024 has been completed satisfactorily, estimated to reach approximately RMB 132 billion.

The company focuses on discovering medium and large oil and gas fields to continuously solidify the resource foundation for increased reserves and production. In 2025, domestically, it will maintain reasonable exploration investments to ensure stable crude oil reserves and continue to advance natural gas exploration with the goal of establishing three trillion cubic meter gas fields. Internationally, the company will continue to focus on both sides of the Atlantic and countries along the “Belt and Road” initiative. It will persistently advance the drilling of the Guyana project and the rolling exploration of the Nigeria project, actively promote new seismic exploration projects in Mozambique and Iraq, and continue to select new projects with the aim of becoming an operator.

While increasing reserves and production, the company will actively promote technological innovation and green development. In 2025, the company will continue to research key exploration and development technologies in the oil and gas field and advance the construction of intelligent oil and gas fields. Relying on the “Haineng” artificial intelligence model, the company will promote the deep integration of digital intelligence technology with the oil and gas industry to facilitate lean management.

The company will promote the integrated development of oil and gas exploration and new energy, gradually expand the scale of offshore wind power, selectively advance onshore photovoltaics, and continuously improve the level of green electricity substitution. In 2025, it is expected to consume over 1 billion kilowatt-hours of green electricity, an increase of approximately 30% year-on-year. Additionally, the company has incorporated carbon pricing into investment evaluation decisions and is steadily advancing regional CCS/CCUS (carbon capture, utilization, and storage) demonstration projects.

The company places great importance on ESG (Environmental, Social, and Corporate Governance) efforts, integrating ESG principles into its development strategy and governance system. On the environmental front, the company prioritizes environmental protection and conservation, actively implementing low-carbon emission reduction policies and proactively addressing the challenges posed by climate change. Socially, the company is committed to serving society, fostering harmony, benefiting the people, and addressing social needs by actively participating in public welfare activities. In terms of governance, the company adheres to high standards of compliance, strengthens board development, continuously improves corporate governance systems, and aims for sustainable development.