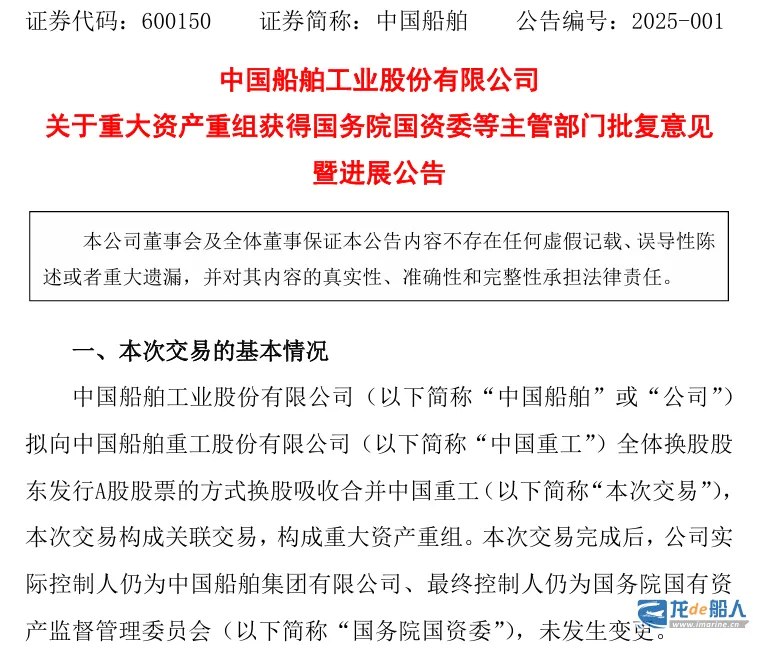

On January 7, China CSSC Holdings Limited (hereinafter referred to as “CSSC”) released “Announcement on the Approval and Progress of Major Asset Restructuring by the State-owned Assets Supervision and Administration Commission of the State Council and Other Competent Departments”.

The announcement disclosed that CSSC proposed to issue A shares to all the shareholders of China Shipbuilding Industry Company limited (hereinafter referred to as “CSIC”) by way of share swap and absorption merger of CSIC. Recently, the State-owned Assets Supervision and Administration Commission of the State Council and other competent departments have issued relevant approval opinions, agreeing in principle to the overall plan of this transaction.

According to the announcement, after the completion of the merger by share swap and absorption between CSSC and CSIC, the controlling shareholder is still CSSC and the ultimate controller is still the State-owned Assets Supervision and Administration Commission of the State Council, without any change.

Previously, CSSC and CSIC announced at the same time on September 2, 2024 that CSSC intends to absorb CSIC by issuing A shares to all CSIC shareholders. The transaction plan released on the evening of September 18, 2024 shows that CSIC will be absorbed by CSSC through a share swap, with 1 CSIC share being exchanged for 0.1335 CSSC shares. The restructuring transaction amount reached RMB 115.15 billion, which is the largest absorption merger transaction in the A-share market in the past decade.

Public information shows that CSSC is the core of China State Shipbuilding Corporation military and civilian products listed companies, listed in May 1998, the integration of China State Shipbuilding Corporation’s large-scale shipbuilding, ship repair, mechanical and electrical equipment, marine engineering and other businesses, its wholly-owned and holding subsidiaries, including Jiangnan Shipyard, Waigaoqiao Shipbuilding, Guangzhou Shipbuilding International, and CSSC Chenghi Shipyard.

CSIC is a leading listed company engaged in ship R&D, design and manufacturing. It was listed in December 2009. China State Shipbuilding Corporation is the indirect controlling shareholder of CSIC. CSIC owns modern large-scale shipyards including Dalian Heavy Industry, Wuchang Heavy Industry, Qingdao Beihai Shipyard, etc. Its main businesses cover five major sectors, namely marine defense and marine development equipment, marine transportation equipment, deep-sea equipment and ship repair and modification, ship accessories and electromechanical equipment, strategic emerging industries and others.

Since CSSC and CSIC have a high degree of overlap in the field of shipbuilding, they constitute intra-industry competition. This reorganization will solve the intra-industry competition problem between CSSC and CSIC in the field of shipbuilding business. After the reorganization is completed, the surviving listed company will become the world’s largest flagship shipbuilding listed company leading the world in terms of asset scale, operating income scale, and number of ship orders.

In the first three quarters of 2024, the operating income of CSSC and CSIC were RMB 56.169 billion and RMB 35.270 billion, respectively; and net income attributable to parent was RMB 2.271 billion and RMB 934 million, respectively.