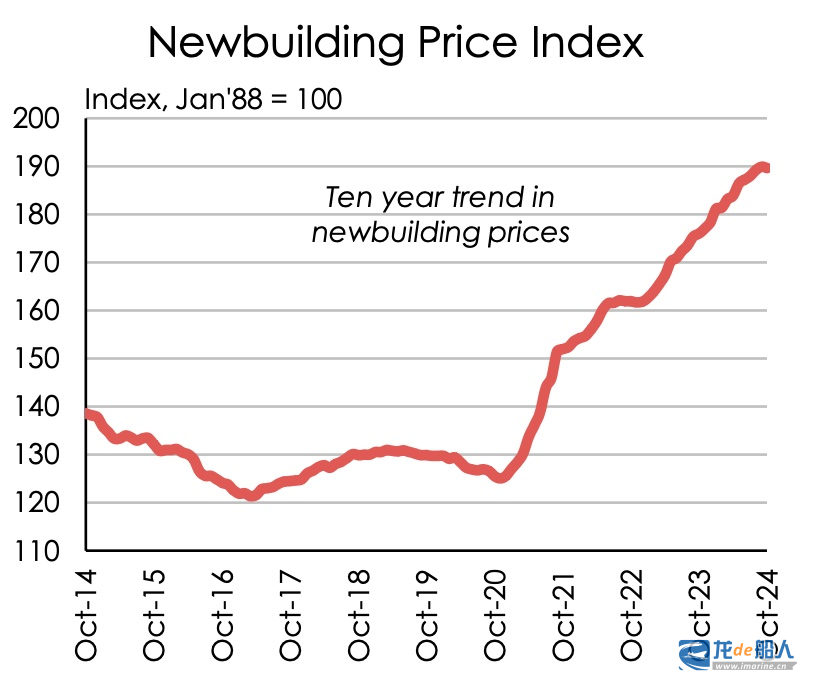

Newbuilding prices are at their highest level since peaking in 2008.

The Clarkson Newbuilding Price Index currently stands at 189.6 points, close to the peak reached in August 2008 (191.51 points) and up more than 50% from the lows seen at the end of 2020. In its weekly report, Clarkson noted that “newbuilding prices remain at high levels, supported by strong order books, firm forward guarantees and continued inflationary pressures at shipyards.

“A new report from another researcher, VesselsValue, noted that ‘the large number of orders placed for container ships and liquefied natural gas (LNG) carriers in 2021/22 is putting more pressure on shipyards’ capacity and construction cycles.” As the surge in orders, shipyards have gained an advantage in price negotiations and prices have climbed.

This has been a bumper year for Asian shipyards, with the average price of newbuildings hitting record highs. Clarkson data shows that the average price of newbuildings reached US$90 million in 2024, 30% higher than the high point set in 2022 and well above the average price of close to US$50 million over the past decade.

According to Clarkson, the growing popularity of environmentally friendly technologies, a higher-value product portfolio, and shipowners signing up for larger ships are all contributing factors to the rising price of new ships. For example, the average tonnage of ships ordered this year is 54,000 tons, a record high and 40% higher than the average of the past decade; and higher-cost ship types, such as LNG carriers, container ships and cruise ships, accounted for nearly 50% of the tonnage ordered this year, compared to 28% in 2010.

Shipbuilders have seen strong order growth in most markets so far this year, with tonnage contracted in the first nine months alone (93.6 million gross tons) already exceeding the full-year totals for 2022 and 2023. Clarkson expects new orders to exceed 100 million gross tons for the full year. This is the peak in recent years, although it is still below the 2007 record of 172 million gross tons.

According to Greece’s Xclusiv Shipbrokers, the order-to-fleet ratios for bulk carriers, tankers and gas (LNG and LPG) carriers as of September 2024 were 10.3%, 12.9% and 48.4%, respectively, which is a significant increase from the previous year and even two years ago. Over the past two years, the order-to-fleet ratios for bulk carriers, tankers and gas carriers have increased by 43%, 180% and 29%, respectively.

Container ships: Alphaliner expects this year to be a record year for container ship orders, with a total of 264 new orders for container ships, equivalent to 3.11 million TEUs, as of mid-October. brokerage firm MB Shipbroking said that, aggregating projects under negotiation, it is expected to add more than 400,000 TEUs of new orders for container ships this year.

Tankers. Orders for tankers soared last year to the highest level since 2015 and have continued at a strong pace this year. Confirmed and announced orders for tankers so far this year stand at around 340, which is close to last year’s full year total of 350.

Bulk Carriers. According to brokerage firm SSY, new bulk carrier orders remained strong in the third quarter of this year, with handysize bulk carrier orders in particular hitting the highest number of new orders in a single quarter since the first quarter of 2017.

Stamatis Tsantanis, chairman and CEO of shipowning company Seanergy Maritime Holdings, said, “Whenever a shipbuilder has a new design, the price goes up and the delivery time is extended. A traditional Capesize bulk carrier now costs $80 million. I think that’s incredible.”

Alan Hatton, CEO of Foreguard Shipping, believes that newbuilding prices are close to their peak and that there is now a gap between the price of building a ship and the cost of inputs. He added that placing an order now is risky given the uncertainty of many of the geopolitical factors affecting shipping prices, such as the Russo-Ukrainian war and the war around the Red Sea.