According to shipping analyst Alphaliner, the current top 10 liner owners have 431 containership orderbook in hand, with a total capacity of more than 5.9 million TEU. Coupled with record orders for liquefied natural gas (LNG) carriers, Asian shipbuilders are having a hard time freeing up newbuilding slots for tanker and bulk carrier owners.

“Additional containership orders in China… are increasingly taking up shipyards’ capacities,” broker Gibson noted in a recent report. “Combined with the further strengthening of containership market enquiries, the slots available for tanker newbuildings are competing with those for containers, affecting yards’ sentiments and ability to maintain their pricing and confidently promoting their forward deliveries.”

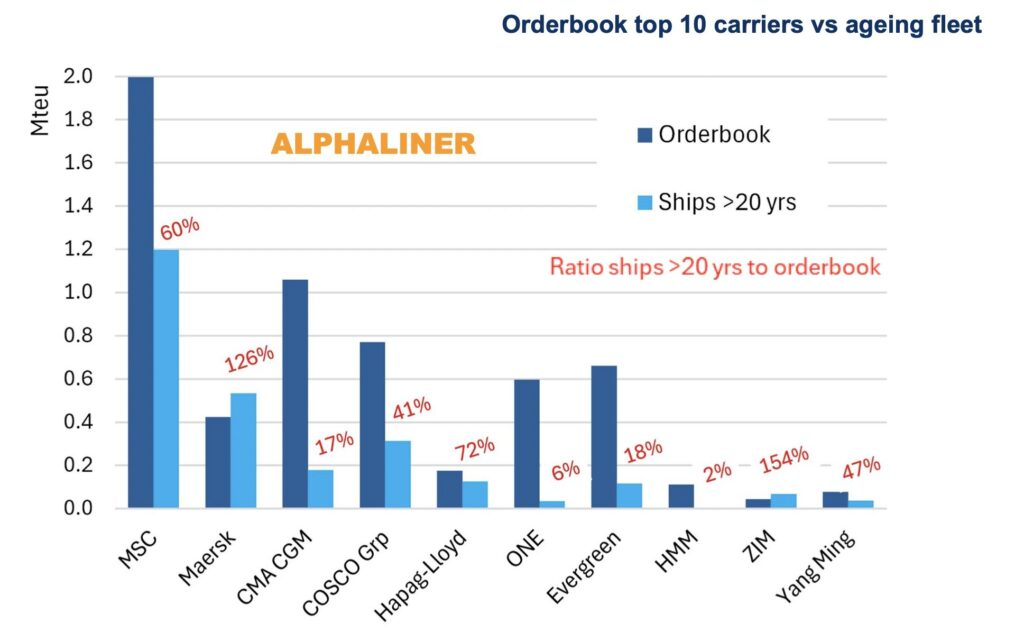

By the end of August, this year’s container ship newbuilding order book had already exceeded the total order book for the whole of 2023, with a large number of container ships set to be ordered in the coming weeks. While the global container fleet is set to grow significantly over the next few years, Alphaliner’s data (see chart below) shows that nearly half of the new ship orders from the world’s top 10 liner owners are actually for the replacement of old ships.

Currently, the world’s top 10 liner owners still operate 683 ships that are 20 years old or over, with a capacity of more than 2.6 million TEUs, according to Alphaliner data. Assuming a normal commercial life of 25 years for ocean freighters, this suggests that the top 10 liner owners could spend 44% of their total orderbook on replacing old ships in service rather than expanding their fleets.

Alphaliner data shows that only one liner owner has not ordered a sufficient number of new ships to replace its old fleet, with Maersk clearly lagging behind its peers in renewing its aging fleet and showing relative inactivity, as shown in the chart above.

Nonetheless, Maersk announced in August this year that it will add 800,000 TEU of fleet capacity in the 2026-2030 period, equivalent to 50-60 ships. Of this, 300,000 TEU of capacity will come from Maersk’s newbuilding program, while 500,000 TEU of capacity is planned to be acquired through time charter agreements. In this regard, Alphaliner does point out that the “bare” data shown above is somewhat distorted and not favorable to Maersk.

Translated with www.DeepL.com/Translator (free version)