Guangdong Songfa Ceramics Co., Ltd. announced on September 30 that the company and Suzhou Zhongkun Investment Co., Ltd. has signed a “major asset reorganization intention agreement”, agreed to carry out a major asset reorganization.

Guangdong Songfa intends to dispose of some or all of its assets and liabilities through one or more combinations of asset disposal and asset exchange, and also intends to purchase certain equity interests in Hengli Heavy Industry Group Limited or certain equity interests in the subsidiaries of Hengli Heavy Industry through one or more combinations of asset replacement and issuance of shares to purchase assets. The specific scope of the underlying assets is still under discussion and has not yet been finalized. In addition, the transaction intends to issue shares to specific investors to raise matching funds.

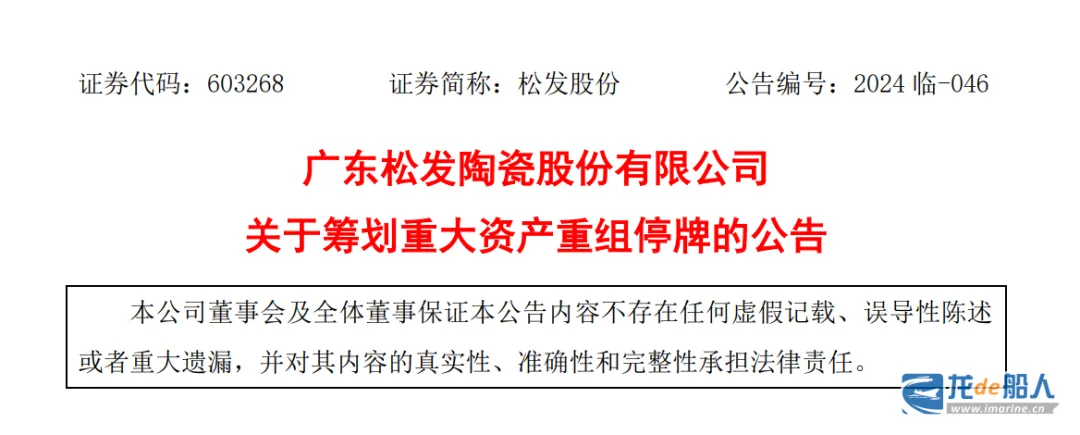

The announcement stated that the transaction is expected to constitute a major asset reorganization, which is expected to constitute a connected transaction and does not constitute a restructuring and listing. Its shares have been suspended from trading since the market open on September 30 and will continue to be suspended from the market open on October 8, with the suspension (cumulative) expected to last no more than 10 trading days.

Guangdong Songfa is mainly engaged in ceramic supplies such as home ceramics, customized ceramics, hotel ceramics, ceramic wine bottles and other ceramic supplies. In recent years, affected by the market downturn and declining demand from major customers, the ceramics business has gradually shrunk and sustained losses. Guangdong Songfa lost RMB 309 million, RMB 171 million, and RMB 117 million in 2021, 2022, and 2023, respectively; and in the first half of 2024, it lost RMB 34.73 million.