Pangaea Logistics Solutions Ltd. (“Pangaea” or the “Company”), a global provider of comprehensive maritime logistics solutions, and M.T. Maritime Management (USA) LLC (“MTM”), managers of a diversified fleet of tankers and dry bulk vessels, announced a definitive agreement to merge fifteen handy-size dry bulk vessels into Pangaea’s 26 vessel supramax, ultramax, panamax and post-panamax fleet.

The handy vessels are currently owned by Strategic Shipping Inc. (“SSI”), a privately held company managed by MTM located in Southport, Connecticut. The fifteen handy-size vessels are valued at approximately $295 million, inclusive of vessel related financing agreements of approximately $102 million, resulting in a total net asset value of $193 million.

As consideration, Pangaea will issue approximately 19.0 million shares of its common stock to SSI equal to approximately 29% of the Company’s outstanding common stock upon completion of the proposed transaction, which represents the relative net asset value of SSI’s vessels compared to the estimated net asset value of Pangaea of approximately $478 million, or about $10.20 per share. The transaction is expected to close in the fourth quarter 2024, subject to customary closing conditions and shareholder approval.

“This transaction represents a transformational strategic milestone for our business, one that expands our owned fleet by nearly 60%, to 41 vessels, and provides us opportunities to drive incremental growth and improve our efficiency and profitability,” stated Richard du Moulin, Chairman of the Board of Pangaea Logistics Solutions. “The addition of the SSI vessels to our existing fleet is consistent with our strategic focus on upgrading our owned vessel fleet to meet the evolving cargo needs of our customers.”

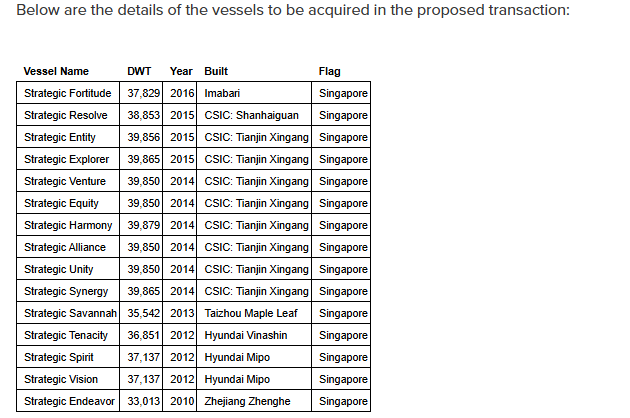

The transaction will consist of Pangaea’s acquisition of 100% ownership in fifteen handy-size vessels ranging in size from 33,000 dwt to 40,000 dwt, with an average age of approximately ten and a half years. As consideration, Pangaea will issue approximately 19.0 million of new common shares to SSI’s owners. The exact number of common shares to be issued in the transaction will be determined at close, based on the relative fair net asset values of the acquired fleet and Pangaea’s balance sheet, as adjusted to reflect current fair values of its fleet. Cash consideration will be limited to net working capital contributions, if any, at the time of closing, The Company will assume responsibility for performance of all current charter commitments associated with the SSI fleet.

In addition, seven employees on MTM’s dry bulk chartering and operations teams will join the Company. Dan Schildt, MTM’s Senior Vice President of Dry Cargo and Strategic Planning, will also join the executive management team of Pangaea as Chief Strategy Officer. Pangaea will maintain an office near Stamford, Connecticut after closing. As part of the transaction, SSI will receive the right to designate two members for appointment to the Board of Directors of the Company.