Recently, Singaporean offshore giant Seatrium (formerly Sembcorp Marine) released its H1 2024 Financial Results.

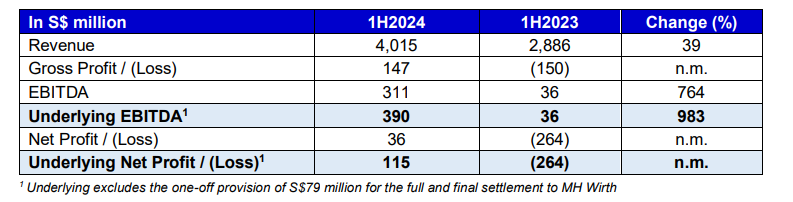

The report showed that Seatrium returns to black in 1H2024 with underlying net profit of S$115 million, the first time since its formation in 2023. Seatrium recorded a revenue of S$4.0 billion for 1H2024, a notable 39% growth from S$2.9 billion for 1H2023, mainly due to progressive revenue recognition from newbuild projects and increased repairs & upgradesactivities.

The Group’s underlying performance also improved. Seatrium’s underlying EBITDA was S$390 million for 1H2024, excluding the one-off provision of S$79 million for the full and final settlement to MH Wirth. This was an improvement from 1H2023’s EBITDA of S$36 million and was backed by improved margins and lower overheads.

Reflecting the increased activity and continued project execution, underlying net profit for 1H2024 was S$115 million, reversing from a net loss of S$264 million for 1H2023.

Mr Chris Ong, CEO of Seatrium, said, “We are pleased to deliver a stronger set of financial results, achieving profitability in 1H2024. The team has been working hard as One Seatrium, prioritising integration, project execution and operational efficiency. We are achieving synergies and making good progress in our transformation journey. As we work towards our 2028 targets, we will continue to grow our order book, build a leaner cost structure and execute our projects well. Through these, we are building a sustainably profitable and resilient business, and creating value for all stakeholders.”

Strong execution of a growing order book

In 1H2024, the Group secured order wins of S$13.4 billion, testament to the success of the One Seatrium Global Delivery Model. These new orders included production units for MODEC, Petrobras, SBM Offshore and Shell, as well as an offshore wind solution for TenneT TSO B.V.

Seatrium’s net order book stood at S$26.1 billion as at 30 June 2024. This represents a 61% increase from end-2023 and is the highest net order book in a decade. About S$9.3 billion (35%) of the net order book are renewables and cleaner/green solutions, an increase from S$6.3 billion as at end-2023.

Seatrium also secured a series of major Repairs & Upgrades contracts, reinforcing its reputation as a market leader. This includes the world’s first full-scale, turnkey Carbon Capture and Storage (CCS) retrofit from Solvang ASA. In the year to date, the Group has signed five other favoured customer contracts (FCCs) with shipowners to service their vessels over the next few years. These FCCs are testament to the value Seatrium brings to its customers, aids forward capacity planning and adds to the Group’s recurring revenue base.

During the first half of 2024, Seatrium continued to focus on the execution of the projects in its order book and improve on operational efficiencies. The Group delivered Singapore’s first newbuild Membrane LNG Bunker Vessel, Brassavola, and completed 133 Repairs & Upgrades projects. Seatrium remains committed to operational excellence whilst maintaining the highest standards of quality.

Strengthening balance sheet

The Group continued to improve its financial health in 1H2024. Net leverage ratio was 2.9 times as at 30 June 2024 compared to 3.2 times as at 31 December 2023.

To lay the foundation for growth, the Group secured a S$1.1 billion syndicated bank guarantee facility in July 2024 to support future project needs. Bolstering its access to alternative financing and commitment to sustainability, Seatrium also obtained a S$400 million committed green revolving loan facility from UOB to support environmentally sustainable projects.

Financial Highlights

Although macroeconomic and geopolitical uncertainties persist, the outlook for the offshore & marine industry remains positive, supported by broad-based demand across both the oil & gas and renewables sectors.

Seatrium is committed to sustaining its improved financial performance for the full year of 2024. The Group’s overall performance for the year will depend on the completion of its legacy projects, the safe, timely, and on budget execution of its order book, and the implementation of identified cost saving initiatives to achieve a leaner cost structure. Building on the progress it has made, the Group will continue to stay focused on driving operational excellence and sustaining a strong balance sheet.

Seatrium Limited provides innovative engineering solutions to the global offshore, marine and energy industries. Headquartered in Singapore, the Group has over 60 years of track record in the design and construction of rigs, floaters, offshore platforms and specialised vessels, as well as in the repair, upgrading and conversion of different ship types.

The Group’s key business segments include Oil & Gas Newbuilds and Conversions, Offshore Renewables, Repairs & Upgrades, and New Energies, with a growing focus on sustainable solutions to advance the global energy transition and maritime decarbonisation.