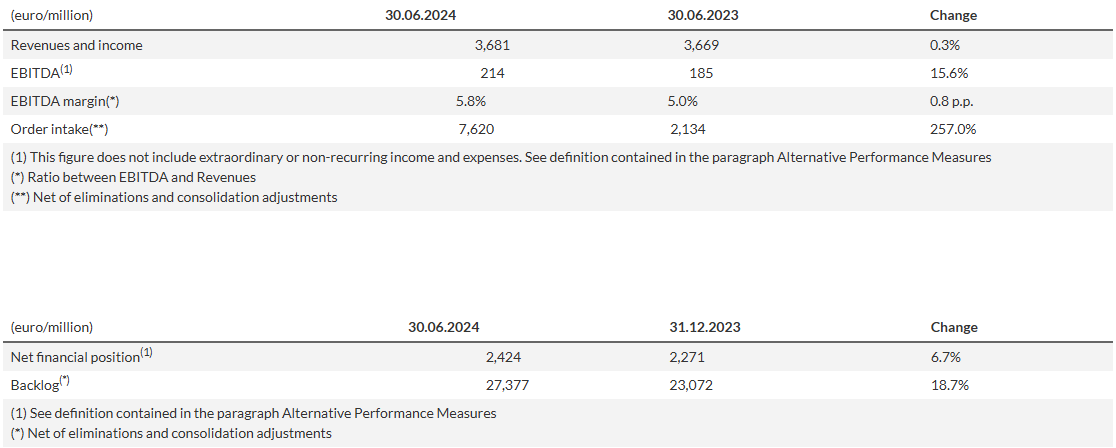

On July 30, Italy’s Fincantieri, one of the world’s largest shipbuilding groups, released its First Half 2024 Financial Report. The financial report shows that as of June 30, 2024, Fincantieri achieved operating income of €3,681 million (about $3,987 million), a slight increase of 0.3% year-on-year; adjusted net loss of €10 million (about $10.83 million); its earnings before interest, taxes, depreciation and amortization (EBITDA) will be €214 million ($232 million), up 15.6% year-on-year, with an EBITDA margin of 5.8%, a significant increase in profitability.

Commercial PERFORMANCE

- Order intake at euro 7.6 billion, more than 3 times 1H 2023 orders (euro 2.1 billion) and higher than the entire FY 2023 (euro 6.6 billion)

- Book to bill of 2.1x and commercial pipeline rapidly accelerating, driven by cruise and defence businesses

- Backlog at euro 27.4 billion, up 19% compared to FY 2023, with total backlog reaching a record level of euro 41.1 billion, approximately 5.4 times 2023 revenues

- 7 ships delivered from 5 shipyards and 96 ships in portfolio with deliveries scheduled up to 2032

2024 Guidance

- Fincantieri confirms 2024 targets for revenues and EBITDA margin and improves its guidance for Leverage Ratio:

– Revenues at approximately euro 8 billion, up by around 4.5%

– EBITDA margin at around 6%

– Leverage ratio (NFP/EBITDA) expected between 4.5x and 5.5x (excluding the rights issue effect – value between 3.7x and 4.7x including the temporary effect of the rights issue), improving when compared to the previous 2024 guidance between 5.5x and 6.5x

In the first half of 2024, Fincantieri continues to deliver on the 2023-2027 Business Plan, with results fully in line with year-end targets, in a market context characterized by the recovery in cruise orders and significant opportunities, at national and international level, in the defence sector, with particularly interesting developments in the United States, in the Middle East and Southeast Asia.

The execution of the Group’s growth strategy in the underwater domain is also accelerating. On May 9, 2024, Fincantieri signed the agreement for the acquisition of Leonardo S.p.A.’s Underwater Armament Systems (UAS) business line and, on July 16, 2024, a euro 400 million rights issue aimed at financing the acquisition was successfully completed, with 100% of new shares offered subscribed.

The first six months of 2024 mark a significant growth of order intake, amounting to euro 7.6 billion, approximately 3.6 times the results achieved in the same period of 2023, mainly driven by cruise as well as export and underwater in the defence sector.

As of June 30, 2024, the backlog stands at euro 27.4 billion, up 18.7% compared to December 31, 2023, with a record total backlog (including backlog and soft backlog) at euro 41.1 billion (5.4 times 2023 revenues), driven by a strong commercial acceleration in all business segments.

The Group’s profitability is significantly increasing, with EBITDA at euro 214 million, up 15.6% year-on-year, and an EBITDA margin of 5.8% (+80 bps compared to the first six months of 2023).

In the first half of the year revenues are substantially stable, reaching euro 3,681 million as of June 30, 2024 (+0.3% compared to the first half of 2023), mainly thanks to a strong performance in the Offshore business and a significant expansion in the Infrastructure and Mechanical Systems and Components clusters (the latter driven by the consolidation of the acquisition of Remazel, closed on February 15, 2024). The decrease in Shipbuilding revenues is due to the redefinition of the production schedule of certain ships, agreed with shipowners, with greater advancement expected in the second half of the year. In addition, the contract for two PPA units (Multipurpose Offshore Patrol Vessel) to the Indonesian Ministry of Defence is expected to become effective in the second half of 2024, enabling the Company to confirm its 2024 revenues guidance.

The Net Financial Position is negative at euro 2,424 million, improving from euro 2,813 million as of June 30, 2023, and marginally higher compared to December 31, 2023 (euro 2,271 million).