On July 27, China Shipbuilding Industry Corporation (CSIC) released a series of announcements that its wholly-owned subsidiaries are further optimizing and adjusting the capacity layout of shipbuilding and ship repairing bases by means of “two buy one sell” way to further optimize the adjustment of the shipbuilding and repair base capacity layout to enhance the high-end ship production and construction capacity, speed up the shipbuilding and repair of high-end green intelligent transformation, as well as to achieve the transformation and upgrading of the ship construction.

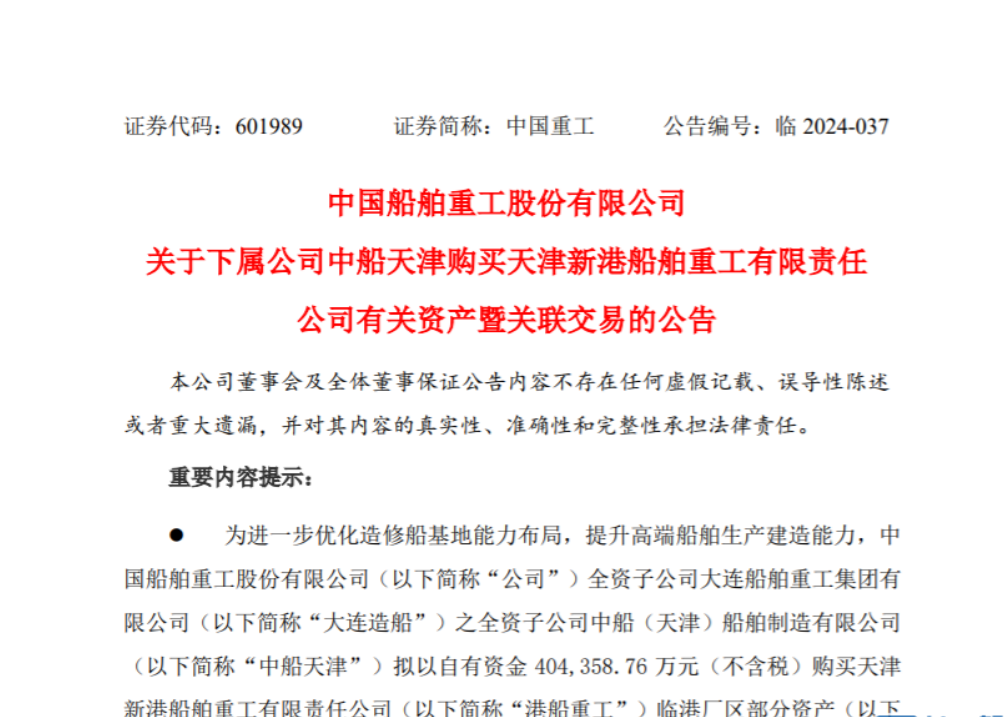

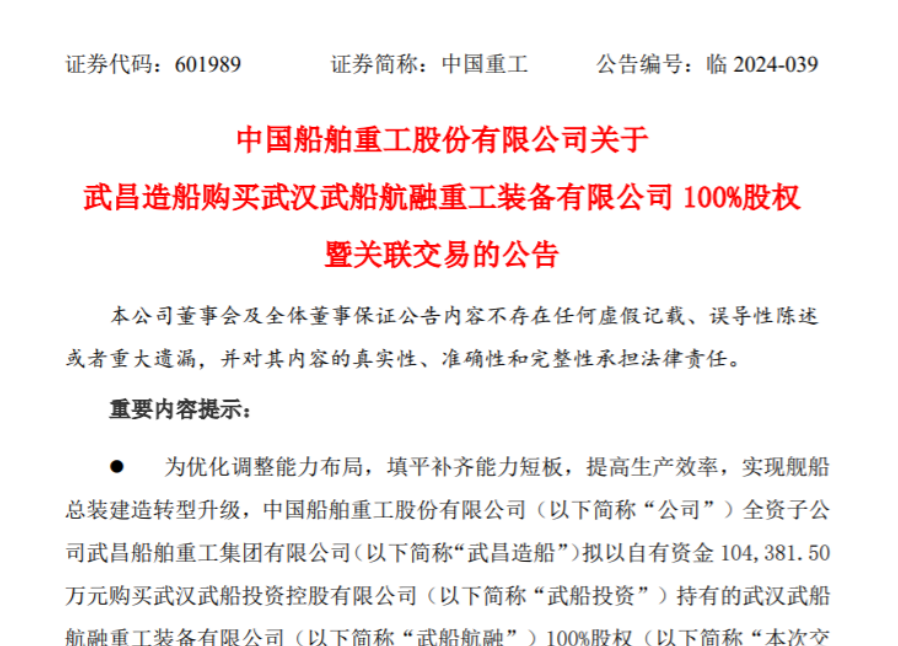

On July 27, CSIC released the Announcement on the Purchase of Relevant Assets of Tianjin Xingang Shipbuilding Heavy Industry by its Subsidiary CSSC (Tianjin) Shipbuilding and the Announcement on Wuchang Shipbuilding’s Purchase of 100% Equity in Wuhan Wuchuan Hangrong Heavy Industry Equipment.

According to the above announcement, CSSC (Tianjin) Shipbuilding, a wholly-owned subsidiary of Dalian Shipbuilding Industry Corporation (DSIC) under CSIC, intends to use its own funds of RMB4,043,587,600 (excluding tax) to purchase part of the assets of the Lingang factory of Tianjin Xingang Shipbuilding Heavy Industry. CSIC’s wholly-owned subsidiary Wuchang Shipbuilding Heavy Industry Group (WS) intends to use its own funds of RMB 104,381,500,000 to purchase 100% equity interest in Wuhan Wushang Hangrong Heavy Industry Equipment Co.

According to the announcement, some of the assets purchased by WS from Lingang factory of Tianjin Xingang Shipbuilding Heavy Industry are mainly fixed assets and intangible assets, including 7 pieces of land, 1 piece of sea area, 318 pieces of buildings and structures, 6,068 sets of machinery and equipments, 16 sets of vehicles and 1,151 items of electronic equipments.The above assets to be acquired are important production resources for shipbuilding, including one 500,000-ton and one 300,000-ton large-scale dry dock, equipped with two gantry cranes, as well as joint plant, segment plant, coating plant, as well as 817-meter outfitting wharf, 858-meter ship repair wharf and 300-meter wharf, such as shoreline resources.

The main assets of Wuchuan Hangrong Heavy Industry Equipment include fixed assets and intangible assets, specifically office buildings, plants, land, machinery and equipment, etc., and there are no other items of liabilities except for incidental taxes payable. Its main business is real estate and production equipment leasing business, and its operating income is all derived from real estate and production equipment leasing income. Wuchuan Hangrong Heavy Industry Equipment is adjacent to WS’s production plant, and in order to ensure normal production and operation, WS is currently leasing Wuchuan Hangrong Heavy Industry Equipment’s land, plant and other assets for use.

According to CSIC, CSSC (Tianjin) Shipbuilding’s purchase of part of the assets of Tianjin Xingang Shipbuilding Heavy Industry’s Lingang factory is aimed at utilizing the shipbuilding and repairing resources in the Bohai region in an integrated manner, further optimizing the layout of DSIC’s shipbuilding and repairing production capacity, effectively increasing the core capacity of CSSC (Tianjin) Shipbuilding’s shipbuilding, and meeting the needs of CSSC (Tianjin) Shipbuilding’s transformation into a high value-added ships. At present, CSSC (Tianjin) Shipbuilding has full orders in hand and the production plan has been scheduled until 2028.

After acquiring the above important production resources for shipbuilding, CSSC (Tianjin) Shipbuilding will continue to carry out transformation and upgrading capacity building on the basis of these assets to build a modern shipyard that can meet the demand for bulk construction of high value-added ships, and effectively guarantee the smooth delivery of its hand-held orders and the future market demand for the main ships to be built. It is estimated that the annual shipbuilding capacity of CSSC (Tianjin) Shipbuilding will increase by 2.4 million DWT after the completion of the transaction.

At present, WS handheld order scheduling to 2028, the acquisition of Wuhan Wushang Hangrong Heavy Industry Equipment, can effectively make up for the WS high-tech products and high-end ship segment construction capacity short board. After the completion of the transaction, the production facilities of WS such as land and plant will be effectively expanded, and all related industries will be gathered in Shuangliu plant to realize intensive and synergistic development, which will improve the utilization rate and production efficiency of assets, realize the transformation and upgrading of shipbuilding, and have a positive impact on the operating results of CSIC. After the completion of the transaction, Wushun Hangrong will become a wholly-owned subsidiary of WS and will be included in the scope of consolidated statements of CSIC.

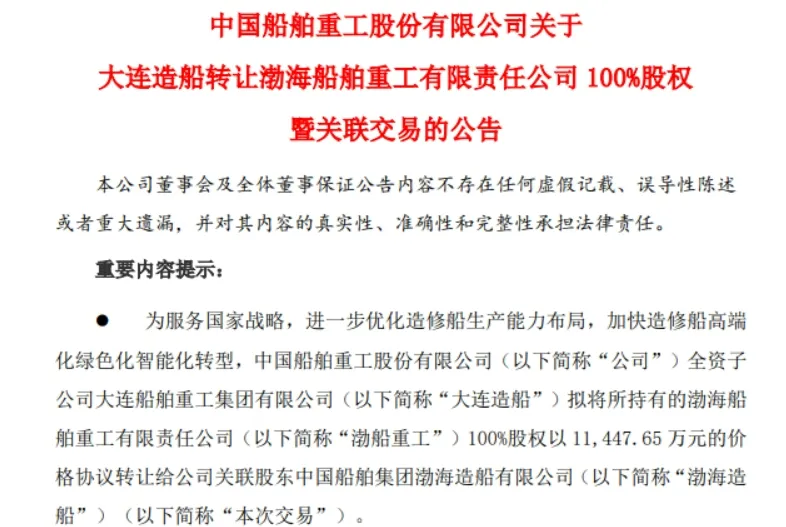

DSIC transfers all shares of Bohai Shipbuilding Heavy Industry for more than RMB 110 million

On July 27, CSIC released the Announcement of CSIC on the Transfer of 100% Equity Interests in Bohai Shipbuilding Heavy Industry Co., LTD by DSIC and Connected Transactions.

The announcement disclosed that DSIC, a wholly-owned subsidiary of CSIC, intends to transfer its 100% equity interest in Bohai Shipbuilding Heavy Industry to Bohai Shipbuilding under China State Shipbuilding Corporation (CSSC), a connected shareholder of the company, at a price of RMB114 million by agreement.

According to the announcement, Bohai Shipbuilding Heavy Industry has suffered losses for 8 consecutive years since 2016 to date due to a significant decline in the scale of revenue, and the accumulated losses amounted to RMB 3.475 billion, which adversely affected the operating results of CSIC. The main reasons for the loss are as follows: Firstly, from 2014 to 2020, due to the deep-rooted impact of the international financial crisis, the global economic growth rate slowed down, the new ship market continued to be in the doldrums, the volume of transactions and transaction prices continued to fall, the shipbuilding industry was at a cyclical low point, the capacity utilization rate continued to be at a low level, and there were generally industry-wide losses in the shipbuilding industry. Secondly, Bohai Shipbuilding Heavy Industry’s main ships are large bulk carriers and ore carriers, etc. Since the beginning of 2015, the structure of the international ship market demand has undergone significant changes, and the demand for bulk carriers has declined rapidly, and the new orders received by this shipyard are obviously insufficient, which has led to a continuous large loss since 2016.

CSIC indicated that the transfer of 100% equity interest in Bohai Shipbuilding Heavy Industry by DSIC is mainly for the purpose of serving the national strategy, further optimizing the layout of shipbuilding and ship repairing capacity, accelerating the transformation of shipbuilding and repairing into high-end, green and intelligent shipbuilding and ship repairing, and realizing high-quality development.

Meanwhile, Bohai Shipbuilding Heavy Industry has continued to incur losses for many years, with accumulated losses exceeding RMB3.4 billion since 2016, which has seriously dragged down the operating results of CSIC. The transfer will effectively end the negative impact of Bohai Shipbuilding Heavy Industry’s continued losses on CSIC. Upon completion of the transaction, Bohai Shipbuilding Heavy Industry will no longer be included in the consolidated financial statements of CSIC.

All of the above three announcements were considered and approved by the Fourth Meeting of the Sixth Session of the Board of Directors of CSIC on July 25, and were also considered and approved by the Strategy Committee of the Board of Directors and the Special Meeting of Independent Directors of CSIC.

On the same day (July 25), CSSC (Tianjin) Shipbuilding entered into the Asset Transfer Agreement with Tianjin Xingang Shipbuilding Heavy Industry; Wuchang Shipbuilding and Wuhan Wuchuan Hangrong Heavy Industry Equipment signed the Equity Acquisition Agreement; DSIC and Bohai Shipbuilding Heavy Industry signed the Equity Transfer Agreement.

From the three announcements of CSIC on the same day, it can be seen that CSIC is accelerating the optimization of production capacity layout and accelerating the transformation of shipbuilding and ship repair business into high-end, green and intelligent.

Public information shows that in June 2017, Bohai Shipbuilding Heavy Industry and Bohai Shipbuilding officially split the line of operation, Bohai Shipbuilding Heavy Industry fully entered the civil ship market.

On March 20, 2019, CSIC announced that it intends to transfer 100% of Bohai Shipbuilding Heavy Industry’s equity held by CSIC to DSIC, and Bohai Shipbuilding Heavy Industry will become a wholly-owned subsidiary of DSIC. Previously, DSIC and Bohai Shipbuilding Heavy Industry were both wholly-owned subsidiaries of CSIC, and CSIC described the integration as being in line with national policy requirements and conducive to CSIC’s future development.

However, the integration did not reverse Bohai Shipbuilding Heavy Industry since 2016 continued to lose money, resulting in CSIC had to take the way of stripping the loss-making assets will be transferred to all of its shares, meaning that Bohai Shipbuilding Heavy Industry and Bohai Shipbuilding will once again “merge” operation.