During second-quarter 2024, the CMA CGM Group delivered a robust performance. The period proved dynamic for global trade and demand for cargo shipping, supported by persistent geopolitical tensions, particularly in the Red Sea region.

These tensions continued to impede the fluidity of global trade in the second quarter, creating congestion in certain regions. At the same time, volumes carried rose sharply compared with the same period in 2023, when US distributors began to draw down their inventories, but also compared with the first quarter of 2024. This is because growth in Western countries held firm, as did household consumption, while inflation slowed due to the impact of monetary policies.

These disruptions brought operational challenges to which the Group responded with agility, thanks to investments in its fleet over the last few years. To support its customers and help alleviate pressure on supply chains, CMA CGM has launched the French Peak Service, an exceptional seasonal shipping line to meet the high demand for shipping between Asia and Europe.

The CMA CGM Group has continued to invest in its industrial capabilities with an order for twelve 15,000 TEU liquefied natural gas (LNG) vessels from Hyundai Heavy Industries. This order is part of CMA CGM’s fleet renewal program, in line with the Group’s target of achieving Net Zero Carbon by 2050, from the vessels’ entry to service in late 2027.

The CMA CGM Group is continuing to integrate Bolloré Logistics, following its acquisition which was completed in late February 2024. From now on, CEVA Logistics and Bolloré Logistics will operate under a single brand – CEVA Logistics – one of the world’s top five in the industry.

Lastly, the Group recently strengthened its media activities with the completion of the acquisition of RMC BFM on July 2, adding to its existing press activities.

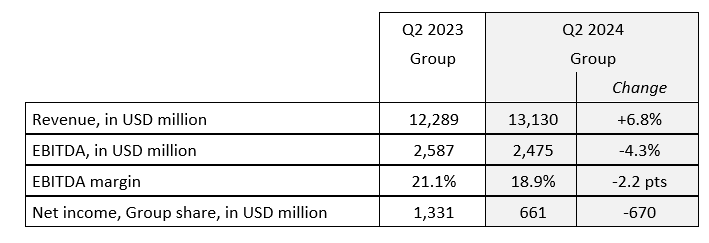

CMA CGM Group: robust performance in a market under pressure

The increase in spot freight rates that began in the first quarter continued into the second. Amid sustained demand, the situation in the Red Sea and the rerouting of vessels via the Cape of Good Hope continued to weigh on available shipping capacity.

Group revenue stood at USD 13.1 billion in the second quarter of 2024, up 6.8%, reflecting stable year-on-year revenue for the shipping business and higher revenue for the logistics business, boosted by the consolidation of Bolloré Logistics since February 29, 2024. EBITDA totaled USD 2.48 billion, 4.3% lower than in the prior-year period, and the margin came in at 18.9%, down 2.2 points.

The Group reported net income of USD 661 million, down USD 670 million. In addition to operating performance, income was impacted by CMA CGM’s contribution to the endowment fund launched with Bpifrance for the decarbonization of the French shipping industry, the contribution to the major port hub project in the West Indies, and the funding of the KYUTAI foundation, the first independent European research laboratory dedicated to open science in artificial intelligence (AI). Through these contributions, the CMA CGM Group is committed to the decarbonization and digitization of maritime shipping and logistics to the benefit of the public interest.

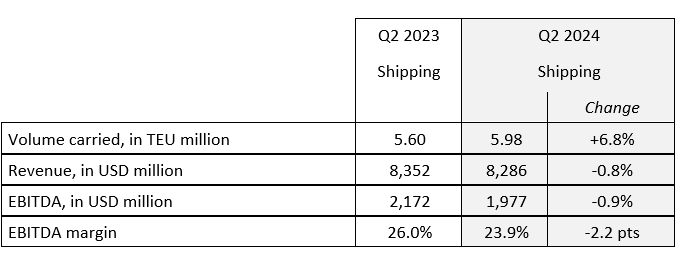

Shipping

In all, 6.0 million TEUs were carried in the second quarter of 2024, up 6.8% from the prior-year period. The increase is due to buoyant world merchandise trade and demand for cargo shipping, led by sustained household consumption and continued inventory rebuilding, impacting Transpacific and Asia-Europe shipping lines among others.

Consolidated revenue from maritime shipping operations amounted to USD 8.29 billion over the quarter, down 0.8% from second-quarter 2023. EBITDA came to USD 2.0 million, 9.0% lower than in second-quarter 2023. EBITDA margin came in at 23.9%, down 2.2 points. Average revenue per TEU amounted to USD 1,385, down 7.1% year on year.

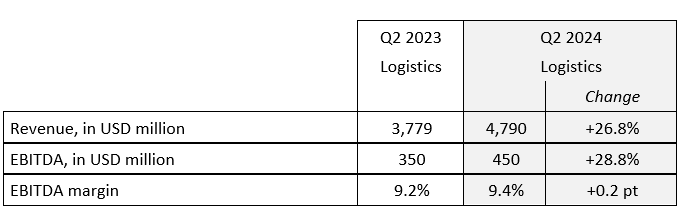

Logistics

In the second quarter, the Group’s logistics activities continued to grow, boosted in particular by the contribution of Bolloré Logistics since its consolidation on February 29 and good momentum in Contract Logistics, Finished Vehicle Logistics and Road Haulage, especially in Europe.

Revenue from logistics operations totaled USD 4.79 billion in the second quarter of the year. EBITDA stood at USD 450 million, a 28.8% increase on second-quarter 2023.

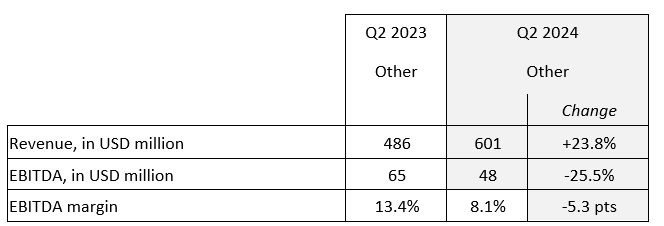

Other activities

Revenue from other activities (port terminals, CMA CGM Air Cargo, media etc.) increased by 23.8% to USD 601 million. EBITDA came to USD 48 million, representing a 25.5% decrease.

All of CMA CGM’s media activities have now been brought together under CMA Media, which includes a press division (La Provence, Corse Matin, La Tribune, La Tribune Dimanche) and an audiovisual division based around RMC BFM.

The volatile macroeconomic and geopolitical environment could continue to affect the fluidity of maritime shipping and logistics.

Focused on cost control and operational discipline, the CMA CGM Group is continuing to invest in its industrial capabilities and digitization in order to offer customers the highest level of service and continue to decarbonize shipping and logistics.