The maritime industry is seeing significant fleet growth in the containership sector as the volume of newbuild deliveries eclipses previous highs.

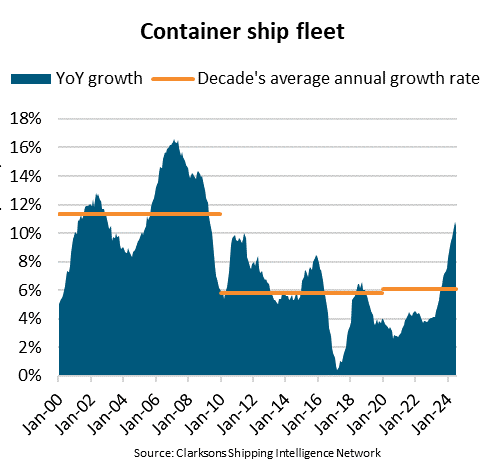

“Since the beginning of the year, the capacity of the containership fleet has increased by 1.6 million TEU. Compared to one year ago, the capacity has risen 11% to 29.5 million TEU, the fastest fleet growth in 15 years,” said Niels Rasmussen, chief shipping analyst at BIMCO.

During the first half of 2024, a total of 264 ships with a combined capacity of 1.6 million TEU have been delivered from shipyards, two thirds more than during the first half of last year when the previous record was set.

In addition, high demand for ships has helped to mute ship recycling activity amid strong cargo volume growth and the rerouting of ships via the Cape of Good Hope to avoid threats in the Red Sea. This year, only 36 containerships with a combined capacity of 51,000 TEU have been recycled.

“Despite the record, shipowners have continued to place orders for new ships. Year-to-date, a total of 63 ships with a combined 400,000 TEU capacity have been ordered, and the order book-to-fleet ratio remains high at 19%,” Rasmussen said.

The current order book, which contains orders for delivery into 2028, will see an average of 1.5 million TEU scheduled for delivery each year between 2025 and 2027.

Fastest growth is being seen in vessels ranging from 12,000-17,000 TEU—now the largest segment within the container fleet, making up 22%. The segment, which was the main growth driver in 2022 and 2023, has grown 25% YoY, accounting for nearly 50% of the overall fleet expansion. The segment will also dominate growth in the coming years as it makes up more than 50% of the capacity on order.

Ships larger than 17,000 TEU dominated growth during 2015-2021 but now only make up 17% of the capacity in the order book as shipowners’ focus shifts away from larger ships that are operationally limited to ports in Asia and Europe. The 212 of these ships already in service cover most of these trade lanes.

“The container fleet’s capacity is expected to exceed 30 million TEU for the first time at the end of the third quarter and hit 30.5 million by the end of 2024. By the end of 2027, the current order book will add another 4.3 million TEU. As cargo volume growth is unlikely to match this expansion, we expect ship recycling to increase and temper overall fleet growth. In addition, if ships can eventually return to the Red Sea and the Suez Canal, demand for ships will fall,” Rasmussen said.