The Fair Trade Commission (FTC) said Monday that it granted a conditional approval for HD Korea Shipbuilding & Offshore Engineering’s (KSOE) acquisition of STX Heavy Industries and its subsidiary, KM Crankshaft (KMCS) accroding to TheKoreaTimes.

As of July. 15., according to the FTC and the shipbuilding industry, HD HHI controlled approximately 61% of the domestic CS market before the acquisition of STX Heavy Industries. STX Heavy Industries’ subsidiary, KM Crankshaft (KMCS), also manufactures and supplies CS, holding around 12% of the market. Consequently, with the acquisition, HD HHI now commands about 73% of the domestic CS market share.

The FTC’s approval comes with conditions, including a prohibition on refusing to supply competitors, guaranteed minimum supply volumes, restrictions on price increases, and a ban on delivery delays for three years. Additionally, the FTC has indicated it will extend these corrective measures if necessary, based on future market conditions.

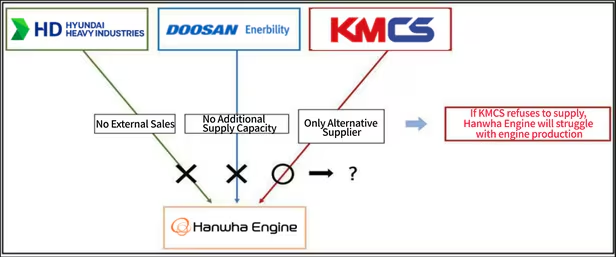

Crankshafts are vital components of ship engines, converting the piston’s vertical motion into rotational motion to power the propeller, thereby determining the engine’s overall performance. In Korea, HD HHI, Doosan Enerbility, and KMCS are the main manufacturers of crankshafts.

Meanwhile, Hanwha Engine currently sources 80% of its crankshafts from Doosan Enerbility and 20% from KMCS. With the recent acquisition, Hanwha will now have to obtain this crucial component from HD HHI, its primary competitor in the shipbuilding industry. HD HHI does not sell its internally manufactured crankshafts externally but only uses them for internal purposes.

Industry analysts predict that Hanwha Engine will seek new suppliers. Doosan Enerbility manufactures crankshafts and main components for nuclear power plants in the same facility. However, due to rising demand for these components, the company lacks the capacity to increase crankshaft production.

Sourcing crankshafts from international suppliers, such as those in China, is an option, but significant quality differences exist. The quality of crankshafts greatly impacts an engine’s lifespan, and shipowners often specify the crankshaft manufacturer when placing orders for ships. Additionally, recent sanctions against Chinese ships by the U.S. and other countries add further complications. The FTC also highlighted that Chinese crankshafts are unlikely to replace domestic products due to concerns over quality, transportation costs, and delivery reliability.