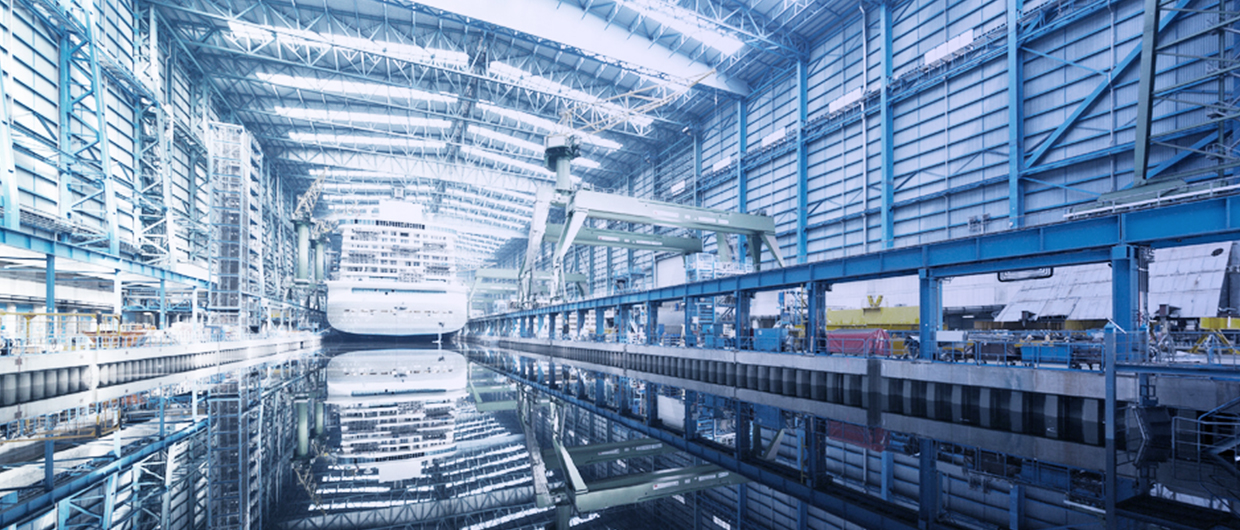

The German shipyard Meyer Werft, known for building cruise ships, is currently facing a financial crisis that has put a number of jobs at the shipyard in jeopardy. The Administration has indicated that it may provide assistance to Meyer Werft, according to ASB Zeitung.

In order to ensure that German shipbuilder Meyer Werft and other European cruise ship builders survive the coronavirus crisis, KfW IPEX-Bank has postponed loan repayments. The German federal government’s initiative gave them a year’s breathing space and saved jobs, based on the website KfW IPEX-Bank website.

The government won’t abandon Meyer Werft in its time of need. Recognizing its crucial significance for the region and employment, they’re prepared to lend a helping hand, mentioned government spokesperson Anke Pörksen in Hanover yesterday. However, talks remain to be held to discuss potential assistance.

As per Hanover’s “Hannoversche Allgemeine Zeitung” (HAZ), state parliament’s budget committee is considering a potential state guarantee of up to 900 million euros for the shipyard. But it’s too premature to address possible financial aid or other support, according to Pörksen.

Meyer Werft is facing a financial gap of 2.7 billion euros that must be bridged by 2027. During a rally in Papenburg, Economic Minister Olaf Lies (SPD) revealed that the jump in equity is part of this sum, making it 400 million euros.

The remaining 2.3 billion euros are expected to come from loans, with over 80% still up for approval. Ideally, this sum should be split between the federal government and the state, according to HAZ. Representatives from the Finance and Economics Ministries refused to comment on this report.

The shipyard is grappling with the repercussions of the Corona pandemic and soaring prices because of the Ukraine war. The contract for the cruise ships was signed prior to the pandemic and does not involve alterations due to the substantially increased energy and raw material costs. Meanwhile, the hesitancy of banks in granting ship loans adds to the shipyard’s financial burden. It receives roughly 80% of the purchase price only upon delivery and must obtain loans to fund construction in the interim.

Nevertheless, despite a fully loaded order book, restructuring expert Ralf Schmitz was brought on board in spring to downsize the workforce. He plans to eliminate 440 jobs, Bremen’s approximately 3,000 employees. This decision is facing opposition from the works council, IG Metall, and the state government. “We’re battling for every single job, for the site overall, and for the ongoing existence of this critical shipyard,” affirmed a spokesperson for the Economics Ministry. Whether the state could offer financial investment is currently mere speculation.

The shipyard needs assistance

“The shipyard needs aid, and without the state and federal government, it’s doomed,” stated Heiko Messerschmidt from IG Metall’s coastal district. Negotiations are currently ongoing with the state, federal government, and the restructurer. The team from VSM intends to hold talks with the company’s leadership regarding a vision for the shipyard’s future.

Compared to Meyer Werft’s chief competitors, Fincantieri in Italy and Chantiers de l’Atlantique in France, their circumstances differ. While they’re predominantly state-owned, these shipyards can easily secure loans at favorable rates. “Even if they’re experiencing financial turmoil, they can easily obtain loans,” said VSM managing director Reinhard Lüken to the “Neue Osnabrücker Zeitung”. “What gives them an edge is their diversified product portfolio. They manufacture not just cruise ships and ferries but also navy ships like aircraft carriers, frigates, and submarines, which ensures they regularly receive government contracts.” “That makes them more resilient,” remarked Max Johns from the Hamburg School of Business Administration to the “Neue Osnabrücker Zeitung”.

“Together with our customers and the export credit insurance agencies, we need to do everything we can to keep the industry from stalling”, says Holger Apel, Global Head of Maritime Industries at KfW IPEX-Bank. Apel is an expert in the cruise industry and is very familiar with the peculiarities of this market. That’s why he fully supports the German federal government’s initiative to defer debt repayments to shipping companies for one year as emergency assistance for coronaviruses.

They will only have to continue to pay the interest. The government, together with KfW bank IPEX Bank and other market experts, developed the concept, which was then implemented in the form of a European initiative. The aim is to provide the industry with some financial breathing space and to ensure that current newbuilding orders are not canceled.

This is because the German Federal Government and KfW IPEX-Bank are working together with German and international consortium banks to provide the industry with around €25 billion in export financing, which is used to secure funding for investments in new vessels. Without the secured financing, for example, the Meyer Werft shipyard would not have been able to use one of its welding machines. KfW bank IPEX Bank is the preferred partner for this sensitive issue.

The initiative of the German Federal Government is having a positive impact.”The order book is alive, there haven’t been any cancellations yet”, confirms financing expert Apel. Shipping companies and shipbuilders have reached an agreement to extend existing orders, as additional orders for newbuildings cannot be expected under the current circumstances. “In the near future we will only build one large and one small ship instead of two large and one small ship per year”, explains Meyer CFO Bollenbach. This should ensure a near future for the shipbuilder with many jobs and a supplier industry, which is mainly characterized by small and medium-sized enterprises (SMEs).