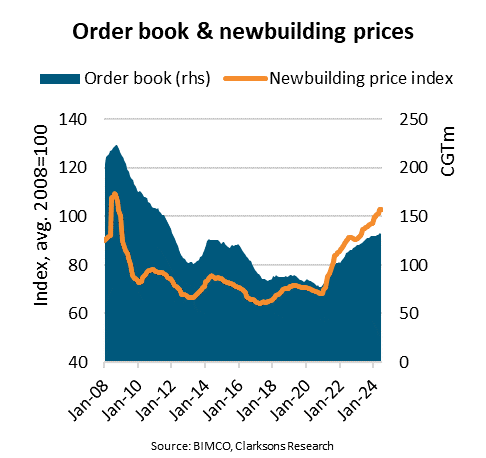

“Since the start of the year, newbuilding prices have risen 3% to their highest level since 2008. Compared to their most recent low in late 2020 they are up 53%. During the same period, the order book has grown by 72%, reaching its highest level since early 2012 and is up 2% year-to-date,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.

Shipyards’ global order book currently stands at 133m Compensated Gross Tonnage (CGT), an increase of 56m CGT compared to the order book’s most recent low in late 2020. LNG and container ships have accounted for respectively 35% and 30% of the increase while bulk carriers, tankers and LPG have accounted for the rest.

The order book for container ships, however, peaked during the first quarter of 2023 and has fallen since. Year-to-date, the container ship order book has fallen 16%, deviating from the overall growth trend together with the bulk carrier order book which is down 3%.

So far this year, the tanker and LNG segments combined have been the main drivers of growth in the global order book. In addition, the LPG tanker, cruise ship, chemical tanker and RoRo ship order books have seen double digit growth.

Between 2010 and 2020, the shipyard industry was plagued by overcapacity. Therefore, prices only varied +/- 10% from the period’s median price.

Assuming that the available shipyard capacity in a year equals the maximum delivered in the past five years, we can illustrate both the past overcapacity and how the situation has improved.

Between 2010 and 2020, the median order book vs capacity ratio was 2.2, declining to 1.7 during the second half of 2017. Since then, the ratio has climbed from 2.1 in late 2020 to 3.7 currently, the highest since 2010.

This improvement has helped fuel the price increases. The 53% price increase in just 3.5 years may seem dramatic but it is worth remembering that the average annual price increase between 2010 and 2024 has only been 2.3% even though manufacturing wages in China have more than tripled.

Looking ahead, the need to start replacing the large generations of ships built in the 2000s, as well as the need to decarbonise, appear to bode well for future contracting. Avoiding a massive build-up of shipyard capacity like in 2000s will be critical if shipyards are to avoid a rise in overcapacity and a scenario where prices fall back to the levels seen in the 2010s.