Alphaliner’s June 9, 2024 data shows that the container fleet continues to expand at a rapid pace. In the next few weeks, only another 85,000 TEU or three 24,000 TEU very large container ships (Megamax) need to be delivered, and the container fleet will exceed 30 million TEU for the first time in history.

At the same time, the world’s largest 24,000 TEU-class container ship built by Nantong COSCO KHI Ship Engineering Co, Ltd. (NACKS) “COSCO Kawasaki 398”, completed the launching operation in Nantong, Jiangsu Province, on the afternoon of June 7th.

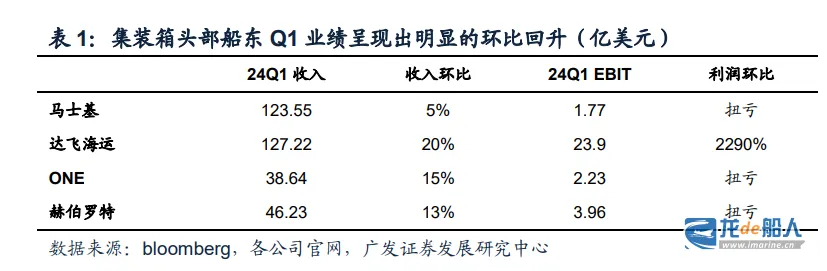

In the case of terminal demand recovery, a number of global head container shipowners in the first quarter performanced to achieve a significant improvement in the ring, revenue growth rate of 5% -20%, profit ring reversed losses. Container ship owners have raised the lower bounds of their full-year earnings forecasts.According to the annual reports of Maersk and Hapag-Lloyd, Maersk raised the lower bound of its full-year EBITDA and EBIT performance expectations from $1/-$5 billion to $4/-$2 billion respectively; Hapag-Lloyd raised the lower bound of its full-year EBITDA and EBIT performance expectations from $1/-$1.1 billion to $2.2/-$0 billion respectively.

The New Fortune listed analysts and GF Securities report that the resonance of four factors to form the shipowner order power, the second order wave of container ships has been gradually approaching: The phase excess capacity is expected to be digested in 27-28 years, matching the decision-making cycle of shipowners; The order structure of the last wave of shipowners order is unbalanced. And the current head of the shipowner hand-held orders account for a higher proportion, and small and medium-sized shipowners hand-held orders accounted for the basic proportion of matching with the proportion of the old ship; The order structure of the last round of order for ship type is imbalance, the current different sizes of ship type hand-held orders account for a significant gap, the head of the shipowner’s feeder ships and other small and medium-sized ship type back to fill the demand is expected to rise; Environmental protection + old age replacement demand space is large.

According to Clarksons, all container ship orders since 2024 have been taken by Chinese shipyards, while South Korean shipbuilders have significantly shifted their order-taking strategy to focus on gas carriers, with the structure of new orders so far this year mainly including LNG carriers, VLACs, VLGCs, etc., as well as part of the tanker and chemical tankers.

GF Securities said that in the shipowners profit center improvement, phased excess capacity gradually digestion, ship type and shipowners order structure imbalance and environmental protection drive, the second order tide of container ships or to, is expected to form three kinds of order main resonance with tankers, bulk carriers, the shipbuilding industry cycle with long sustainability and sufficient upward momentum.

In terms of container manufacturing, the New Fortune listed analysts, Dongguan Securities believes that with the inventory cycle stabilized and red sea event long-term, container manufacturing is expected to rebound.