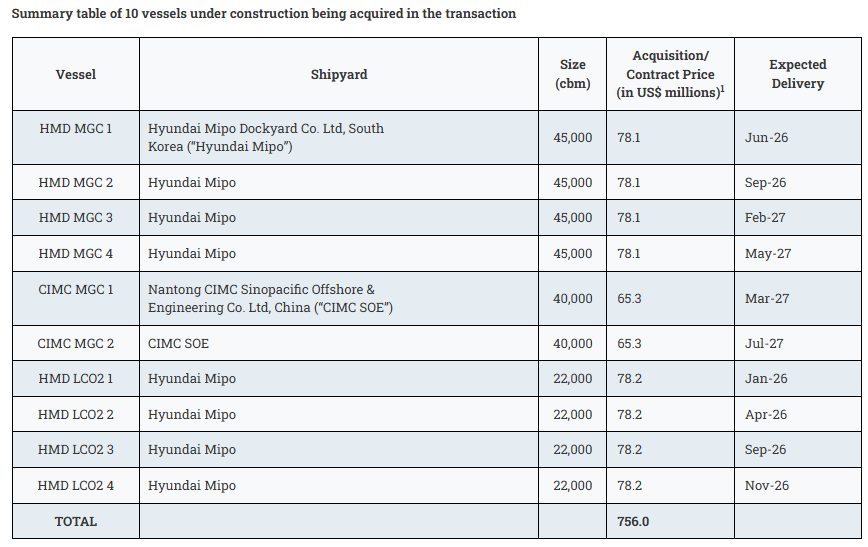

On June 4th, Capital Product Partners L.P. (CPLP), an international owner of ocean-going vessels, announced an important strategic investment in 10 latest technology gas carriers. The investment made by CPLP is for 10 new gas carriers (the “Gas Fleet”) for USD 756.0 million with expected deliveries between the first quarter of 2026 and the third quarter of 2027.

Among them, Six vessels are Dual Fuel Medium Gas Carriers (MGCs) and four are Liquid CO2 Handy Multi Gas Carriers (LCO2s).This is a unique opportunity undertaken by CPLP to increase its footprint into the conventional gas and energy transition gas sectors, whilst retaining the core focus on LNG.

Eight of the ten gas carriers of the above in two types are being built by HD Hyundai Mipo, while the remaining two are being built by Nantong CIMC Sinopacific Offshore & Engineering (CIMC SOE). The construction awards for this series of newbuilds were financed with $182.5 million in gross proceeds (net of debt repayments) from CPLP’s sale of seven container ships between February 2024 and May 2024, as well as other cash on hand and debt financing.

Specifically, HD Hyundai Mipo will be responsible for the construction of four 22,000 m3 LCO2 carriers and four 45,000 m3 medium-sized liquefied petroleum gas (LPG) carriers. Of these, the four LCO2 carriers were made public in July 2023 (two) and February 2024 (two), which are currently the largest LCO2 carriers in the world, with a total order value of approximately US$312.8 million. The total value of the order for the four medium-sized 45,000 m³ LPG carriers is about US$312.4 million. CIMC SOE is responsible for the construction of two medium-sized 40,000 m3 LPG/Liquid Ammonia carriers at a cost of approximately $65.3 million each, with a total order value of approximately $130.6 million.

Despite a ship building market which remains very tight in terms of new vessel slot availability, the Partnership has secured these valuable early slots at highly experienced shipyards for these types of vessels. The delivery schedule is attractive with demand fundamentals for the LPG, ammonia and the carbon capture, utilisation and storage (‘CCUS’) business expected to be very strong going forward.

The MGC vessels to be acquired are in line with CPLP’s strategy of acquiring high specification, versatile vessels, which can offer our charterers reduced unit freight cost. They are among a new generation of MGCs that are dual fuel (can burn both LPG and Fuel Oil) and have shaft generators, as well as other energy saving devices, while they offer increased capacity of 15%-30% compared to older generation MGCs. The combination of higher capacity, energy savings and cheaper fuel (LPG) offers very attractive unit freight cost economics, which are expected to command a significant premium compared to their older counterparts, reflecting substantial advancements in both design and technology.

These vessels offer unparalleled trading flexibility, as they are capable of transporting liquid CO2, LPG, and ammonia. Featuring a low-pressure system, they ensure the lowest unit freight cost and are being constructed at high operational specifications, including but not limited to, multiple cargo systems, reinforced cargo tanks, bow and stern thrusters and ice class capabilities. Furthermore, they are alternative-marine-power-ready and with options for ammonia propulsion and/or onboard carbon capture, thus potentially significantly reducing carbon emissions. With the capacity to move more than 1 million tonnes2 of liquid CO2 annually, these vessels are expected to be the workhorses of the ammonia and liquid CO2 industries.

Mr. Jerry Kalogiratos, Chief Executive Officer of our General Partner, said: “I am delighted to see the Partnership taking a significant step in becoming a diversified gas transportation company with a focus on the energy transition. The addition of these 10 state of the art, high specification vessels will allow us to provide our existing customers such as utilities, energy companies and traders with a full range of vessels for all their gas transportation needs, increasing our footprint and reach in the market. While LNG will remain our core competence, with an expected delivered fleet of 18 latest generation LNG carriers by 2027, this transaction puts a strong emphasis on the energy transition, as these new acquisitions will have the capability to move Liquefied Petroleum Gas (“LPG”), ammonia, butane, propylene and liquid CO2. The ship building berths secured are valuable early slots within a very tight ship building market and at highly reputable shipyards for these types of vessels. This strategic investment not only strengthens our market position, but also aligns us with the future of energy transportation, ensuring we remain at the forefront of the industry.”